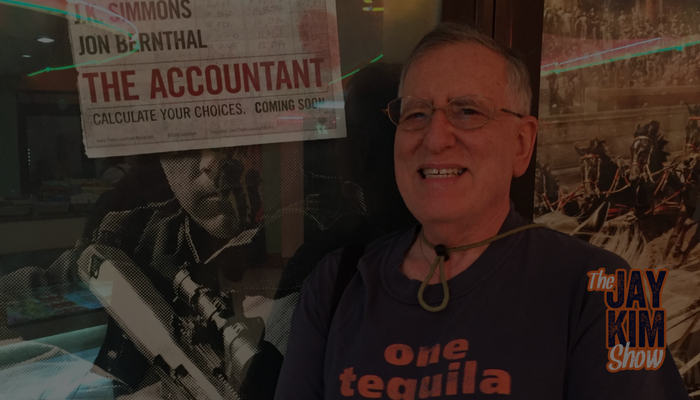

Larry is a feisty, straight-shooting U.S. tax accountant and is a licensed CPA in China, where he’s been living for the past two decades. He’s the author of multiple exciting-looking tax books, and…he’s Jay’s personal tax accountant. Larry has decades of experience deciphering the U.S. tax code, especially as it relates to Americans living abroad.

In today’s episode you’ll learn:

- Why Larry moved to China

- What is FATCA and why it’s so detrimental to U.S expats

- How things will change after “Trump Tax”

- About the IRS’s requirements regarding cryptocurrencies

/

RSS Feed

Listen to this episode on iTunes

What was your biggest insight from this week’s episode? Let Jay know in the comments or on Twitter: @jaykimmer.

LINKS FROM TODAY’S EPISODE

- Read the full transcript from Larry’s interview

- prctaxman@yahoo.com

- Larry’s books at Amazon

- See Larry’s latest presentation on YouTube

DETAILED SHOW NOTES

- (2:04) Jay and Larry chat about the apartment Larry rented in Hong Kong for 23 years

- (3:10) Larry’s self-introduction of his education and early career

- (5:36) Larry explains how he became interested in and why he moved to Asia

- (7:19) Jay and Larry discuss how China has changed over the last 20 years

- (8:17) Larry is licensed as a CPA in China as well

- (9:58) Larry sounds off on “shoddy” Chinese accounting standards

- (12:18) Larry explains the origins of FATCA

- (15:10) Why FATCA makes U.S citizens unattractive prospects to banks abroad

- (16:22) Larry asks, Can anyone read the rules of FATCA and make sense of them?

- (17:55) Jay has seen the detrimental effects of FATCA in Hong Kong among startups with American founders and investors

- (19:25) Larry explains how the tax law has changed under President Trump

- (22:30) The macro effects Larry believes will result of “Trump Tax”

- (24:20) Larry addresses Americans’ fear of the IRS

- (26:11) Jay and Larry discuss instances of IRS letters and change of address forms

- (27:28) Larry explains how the IRS expects citizens to report cryptocurrency transactions. Jay and Larry discuss the many ambiguities and remaining questions regarding reporting crypto trading.

- (32:47) Larry’s tells about his tax books

- (33:52) Larry is taking on new clients

Leave a Reply