Only The Paranoid Survive…

“Don’t be a hero. Don’t have an ego. Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead.” – Paul Tudor Jones

I took a two week vacation at the beginning of May with just my wife. We spent the time sailing along the southern coast of Spain, over to Morocco and then back up to Portugal. It was an amazing time, my first two week vacation in nearly a decade, which is mainly due to the fact that my wife has basically been pregnant for 5 out of the last 6 years with any one of our three kids.

Two weeks is just about enough time to actually switch yourself “off” and unplug for real. The first week I found myself still checking Bloomberg every day, trying to keep my inbox at zero and not fully checking out to enjoy myself. After a week and many cocktails, I finally started to enjoy my time off. My hedge fund had printed solid performance for the first four months of the year and pretty much all risk assets were continuing their rally, even after a strong first quarter.

Global equity markets were making new highs riding on the back of accommodative Fed policy and expectations of a recovery in Chinese economic growth. A positive US earnings season and a healthy US Q1 GDP print further added fuel to the fire. I was feeling good and a bit too relaxed about everything when risk started rearing its ugly head again, as it always inevitably does.

By the time I had returned to Hong Kong the proverbial adage “Sell in May and Go Away” was already in full effect. The resumption of Sino-US trade war had at this point well exposed the underlying fragility of the seemingly never-ending rally and within a matter of 10 days my fund had given back most of the performance for the year. The abrupt return of potential US tariffs to be imposed on China, coupled with the decision to place Huawei on a US trade blacklist, upended the hot start to the year. Investors who were once positioned to capitalize off a swift trade resolution, found themselves having to backpedal and position for a protracted negotiation.

Which brings us to the almighty Fed. The June FOMC meeting basically confirmed the fact that the Fed, for whatever reason you wish to attribute it to (Trump tweets or real economic data) basically committed to embarking on an easing cycle this year. The first cut of an easing cycle always represents a crunch time for financial markets because it always occurs when leading indicators of economic growth are on the cusp of giving a recession warning. That is to say, rate cuts typically begin when markets are trying to decide whether or not a recession, or a financial crisis, is going to occur in the not-too-distant future. Although the Fed is attributing future easing to abnormally low inflation, the reality is that the Fed is worried about an economic slowdown like everyone else – a slowdown that they themselves largely caused. Since the Fed wants to avoid this uncomfortable truth, its commentary has been focused on low inflation.

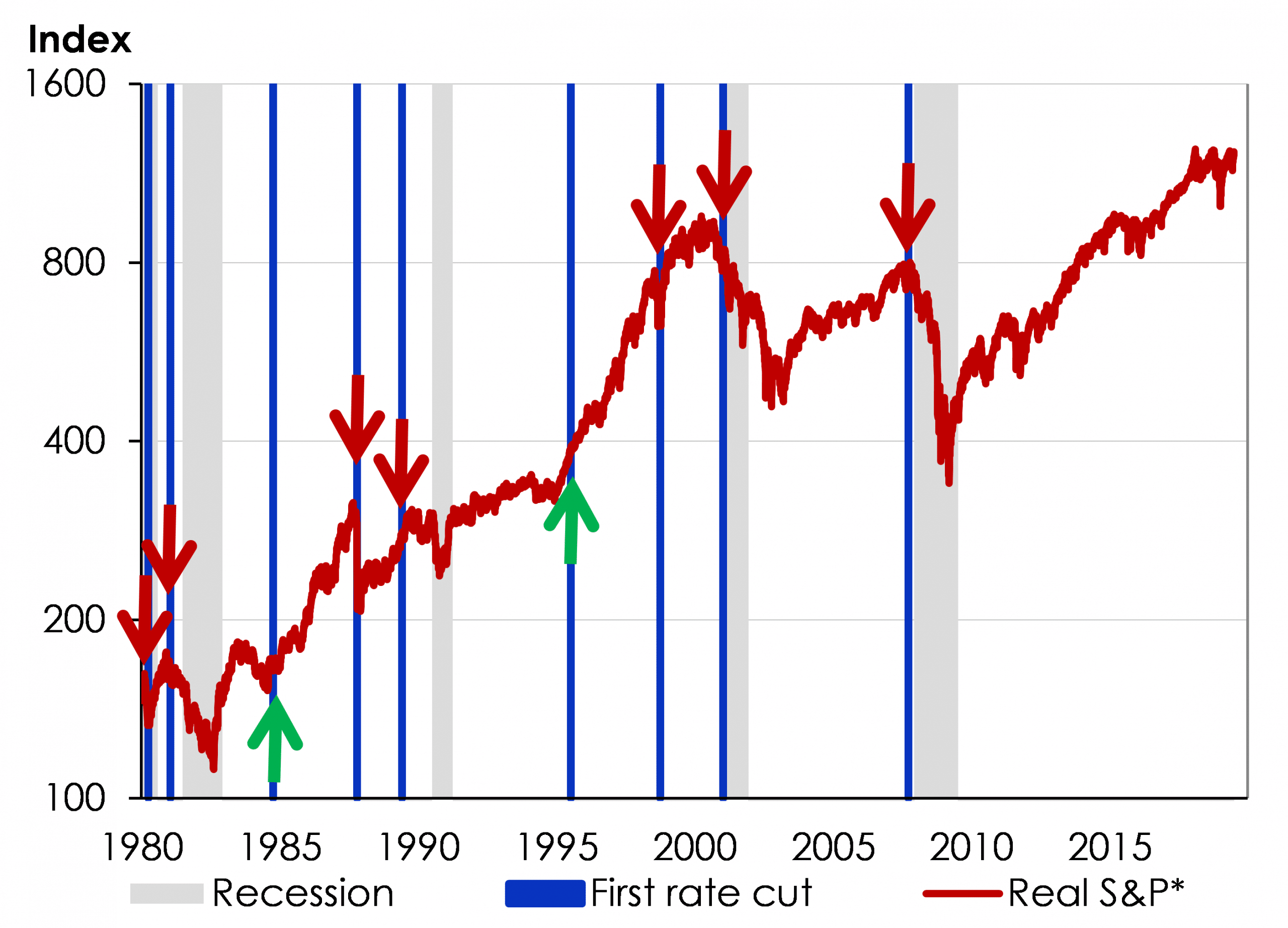

The point I’m trying to drive home here is that the first rate cut of a Fed easing cycle always coincides with heightened risk of recession or of an impending financial crisis.

The fact that so many investors around the world are willing to accept negative interest rates (Japan or EU) at the moment tells us that they fear something far worse than losing money on their fixed income investments: they fear a deflationary collapse. Once the Fed starts easing, investors are forced to decide whether or not the Fed will successfully revive growth or avoid a looming financial crisis. If overall markets believe the Fed can engineer a “soft landing”, they will begin to lift. The first easing will represent a good buying opportunity in risk assets. But if not, a bear market in risk assets will follow. Hence, once the Fed begins easing the outlook for markets becomes binary. This is why the first interest rate cut of an easing cycle almost always coincides with an inflexion point in financial markets.

The first cut in an easing is an inflexion point in the markets. Source: Bloomberg, SilkRoad

Inevitably, there are two schools of thought in the market. The first school believes that the Fed has placed an effective “put” under both the US equity market and the US bond market fully guaranteeing that they will ease aggressively or buy bonds if they need to, in order to prevent large declines in stock or bond prices. At the current moment, this school believes that a hard landing to the US economy will be avoided; expects that the rally in US Treasuries has a long way to run; and expects that the rally in US stocks will run further. The trade war is not a major consideration for this group. They see the effects on the US economy as relatively minor even if a resolution does not actually materialize.

The second school of thought is much less optimistic. This group believes that the delayed effects of past Fed tightening, combined with the negative effects of the trade war, will cause a sustained slowing of global growth into 2020. This group tends to be pessimistic about hopes for a trade deal and sees significant risk of a global recession in 2020. This group also believes that the impact of rate cuts has lost its effectiveness after so many years of ultra-low rates.

Regardless of which school of thought you belong to (and I’m sure you can easily guess which school I subscribe to), the net result of lower interest rates is the sheer fact that as investors, we will find it increasingly difficult to make money in public markets from here on out. Investors have been yield starved for years now (ever since QE) and despite the fact that US equity markets continue to drift to all time highs (fueled by that very same QE which caused a corporate debt binge to fund buybacks) it has left the smart money crowd out by the wayside. As lower industry competition caused by a lower cost of capital overpowers any stimulus that was initially provided by rate cuts, it’s pretty clear what the end result will be. It’s essentially a race to the bottom both from an investors’ standpoint and from a corporate profitability standpoint and it certainly doesn’t bode well for our collective future.

This is why I have and always will be an investment class agnost. As an inherent capitalist, I believe that there is an abundance of money making opportunities which are not limited to just one asset class or market (public or private). This is also why I love early stage investing. It provides a unique element of personal portfolio diversification that you won’t find if you are a one trick investor.

In two weeks time, Hong Kong will be hosting its fifth annual RISE conference, the largest technology conference in Asia featuring 100+ countries, 25,000+ attendees and 1,000+ startups. And since Explorer Equity Group is now an Official Community Partner of RISE, which is the largest tech conference in Asia on July 10th, we’ll be hosting an event during the conference on investing in the cannabis industry. You can join us for free here.

Cannabis is a “hot” space right now which many investors write off simply as a fad but the fact of the matter is the trend is undeniable. Over a dozen US states have legalized the green plant for recreational consumption and even more states have proposed legislation changes in the pipeline. As with every hot new shiny investment object (think 3D printing, AI, VR/AR, Crypto, Cannabis etc, etc) there are a lot of pitfalls and traps that you should be aware of before deploying any sort of meaningful capital in the space.

Fortunately for you, EEG has already spent years studying the space, making the right connections, and we’ve invested millions of dollars profitably already, so we have a pretty good idea of where the best opportunities lie right now.If you are in Hong Kong for the RISE conference this year, please join our event.