Forget Your View

“Timing crashes is impossible. If you require a forecast in order for your investment thesis to do well, then I think you’re doing it wrong.” —Mark Spitznagel, American hedge fund manager

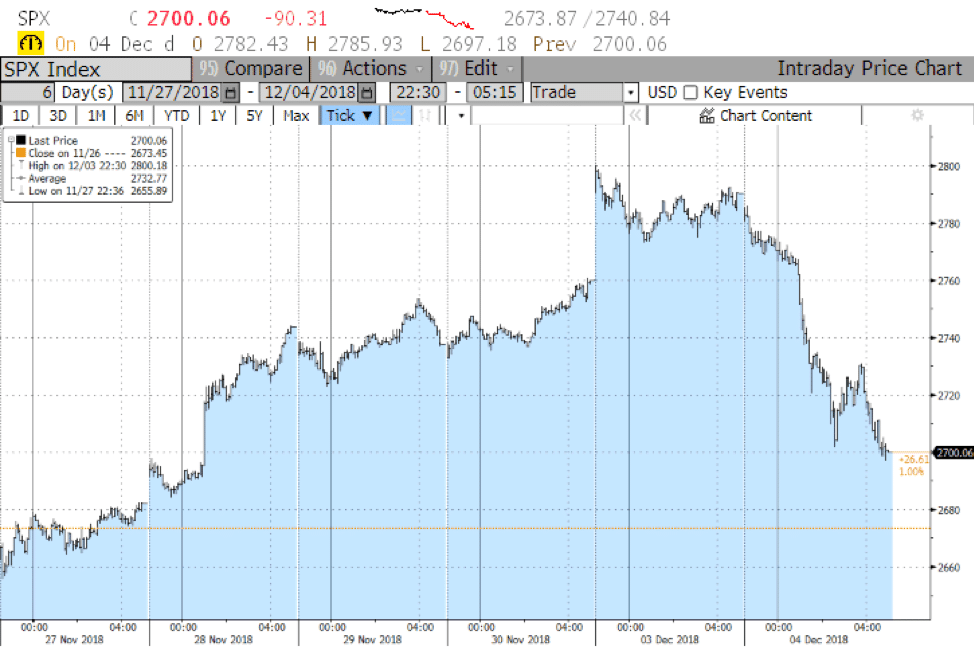

It’s been a flurry of activity this week so far, making for some fun (but volatile) price action in the markets. As we enter the final month of what has unequivocally been one of the toughest years to make money in recent history, everyone and their mothers’ seem to be asking Santa for a Christmas Rally as a consolation prize to end this year on some sort of high note.

It all started last week when Fed Chairman Jay Powell “blinked” which in layman’s terms means that he changed his monetary policy narrative by saying that interest rates are “just below” neutral (their target), hinting at a more dovish stance on rate hikes next year.

The momentum continued over the weekend as positive newsflow emerged from the G20 summit in Buenos Aires pointing to a temporary truce in the trade wars between China and the US. At the same time, Putin and the Saudis agreed to renew their production cuts allowing oil to finally catch a bid.

By Monday morning when I sat down and logged into my terminal, my inbox was flooded with sell-side strategy reports titled “How to Play the Trade Truce” and “What Does G20 Mean for Tech?” Investors felt like kids in a candy store as the good news kept piling in.

As expected, markets ripped.

Shortly thereafter, four separate people asked me what I thought of the rally. One of my business partners, two of my brokers and even my mother-in-law were all curious as to how I thought this would play out, and if we were “in the clear” for the rest of the year. (btw, I hate it when my mother-in-law asks me this question because it’s guaranteed to be a lose/lose situation regardless of what you recommend. If you are ever in the same situation my advice is simple: don’t recommend sh*t.)

The truth is, I’ve been playing this game long enough to know that “what I think of the rally” doesn’t really matter. It’s a leading question that people ask to try and get a view or an opinion out of you. I used to play along with it when people asked me and quite frankly, it’s kinda fun. Everyone likes to play the grand market wizard and lay down predictions of how the market will trade and then come back and rub the “I told you so”s in your face when they prove to be right. If they are wrong, you simply don’t hear back from them. It’s a perfect spectator sport for wannabe investors to engage in to try and sound smart. And to be fair, I’ve been guilty of playing market wizard myself from time to time but as I mentioned before, none of that actually matters.

Lo and behold by Tuesday trading in NY, the markets folded like a cheap suit. The market gave back most of its gains for the prior week, Trump went off the rails again on Twitter, JPM & Nomura came out with notes saying quant and systematic strategies were selling the key 50 and 200 day moving averages of the S&P and Fed’s Williams came out with comments that took a hawkish stance to add icing to the cake.

Source: Bloomberg

Bonds are starting to look interesting as well. The yield curve is currently experiencing a big flattening trend with the 2s5s and 3s5s inverting. What exactly does yield curve inversion mean for those non-bond folks out there? All this means is that the yields on the 2- and 3-years topped the yield on the 5-year. And a short-term debt pays you more than a longer-term debt of the same credit quality. This inversion is said to be a predictor of recessions in the US (it’s happened in each of the past seven, so it’s probably pretty accurate) and it happens when the market doesn’t believe growth is here to stay while the Fed continues the raise the short end of the curve. Pundits say that there is generally a lag between a true yield curve inversion and a recession of up to a year but I sure as hell won’t be bulled up waiting around for that car crash to happen.

That’s why I keep coming back to the fact that it doesn’t really matter what your “view of the market is”. No one knows what will happen. Okay maybe if you are a day trader a view matters but for us and what we do, having a view rarely translates into actually making money. The reason is because human beings are too easily affected by emotions and external factors such as mainstream media, so your precious “view” is liable to change on a moment’s notice.

Forget your view. It doesn’t matter. The only single thing you have control over is protecting your downside. I’m a better seller here and the environment right now is one where you sell rallies and avoid buying dips. But how do you make money then? You have to be patient. Value is starting to look appealing again and unfortunately, there is no hack or shortcut for that one.