Much Ado About Nothing

“Investors should favor strategies, managers, and approaches that emphasize limiting losses in declines above ensuring full participation in gains. You simply can’t have it both ways.” – Howard Marks

One of the best traders I’ve ever known was my old boss at Bear Stearns. His official title was “Head of International Trading” but by the end of his time at Bear (2006-2007) he had made enough money for the firm and was senior enough that he could pretty much do whatever he wanted. Instead of diving into the management track that most Senior Managing Directors were groomed to take, my boss decided he just wanted to trade his own book and continue to make money for the firm. In turn, he was given complete autonomy over his time, and as long as he was posting up PNL for the firm’s bottom line, no one seemed to care.

A few weeks before Christmas in 2006, my boss was nowhere to be seen on the trading floor. He had essentially checked out for the year and was rumored to have executed a large trade in India which generated millions of dollars for the firm. Rumor had it that after the trade was executed he dialed into the desk on his drive out to the Hamptons saying something along the lines of:

“You should be seeing a large positive number hitting our PNL over the next few days as I’ve just closed out my India trade. I’ll be reachable on mobile…Merry Christmas and see you next year.”

Epic.

The fact of the matter was that he was doing the right thing. Not only had he rightfully earned an early holiday break, at a point that late in the year, but him being in the office would also have hurt his performance more than it would have helped it as he would have been tempted to trade around (and lose money). Why risk it in the 11th hour? Better to just call it quits and enjoy the holidays and come back refreshed for the new year.

Ah…the good old days of Wall Street. I doubt any firm would allow such legendary behavior nowadays. But there is an important lesson to be learned from this story and that is the importance of knowing when to quit when you are ahead when to do something different and that sometimes doing nothing is better than doing something.

I’m sure you all can relate to this. Investors often get stir crazy watching the markets and feel like they should be doing something with their hard earned money as opposed to sitting on the sidelines in cash. Competitive traders hate missing out of opportunities to make money but more often than not overtrading is one of the leading causes of losses for impatient investors.

As we enter into the final two months of what has been a very challenging year for investing, a lot of people are wondering how to position their portfolios for year-end. Back in August the S&P 500 passed the defining point of the longest bull market in history. Seasonally speaking, year-end is usually the most positive stretch for equities. But let us not forget that US equities have essentially been the only asset class that has “worked” in the last two years since Trump took office.

Emerging markets have gotten clobbered, Europe is in shambles and approaching a bear market, bonds have not performed well all year and neither have commodities. Gold has also underperformed as it tends to be negatively correlated to US dollar liquidity.

On the macro front, there are a ton of uncertainties ahead of us underpinned by the sweeping rise in populism and dissension among political parties which will come to a head this week during the US Midterm Elections.

Other credible threats to the system that cannot be ignored include the trade war situation with China, unrest in the Middle East (from both the Khashoggi debacle and sanctions on Iran) and last but certainly not least the Fed’s expected action around raising interest rates.

Meanwhile, US economic growth continues to come in strong (Trump is obviously claiming credit for this one) and an upside surprise in inflation is now a real threat to this market as well. Let’s not forget that Fed tightening is the most common cause of post-war US recessions in the history of our country.

So first of all, if you haven’t taken chips off the table yet in equities, I would strongly urge you to do so. If for whatever reason the Republicans sweep Congress tomorrow and we get a stock market rally on the back of that, there’s no better time to cash up into year end. Warren Buffett, one of the world’s best value investors, has up until a few days ago been sitting on over $100 billion in cash. He hasn’t bought anything in years up until yesterday when he announced that he was buying back his own stock. All that means is that he really hasn’t seen any other value investing opportunities out there in the market. Something to think about…

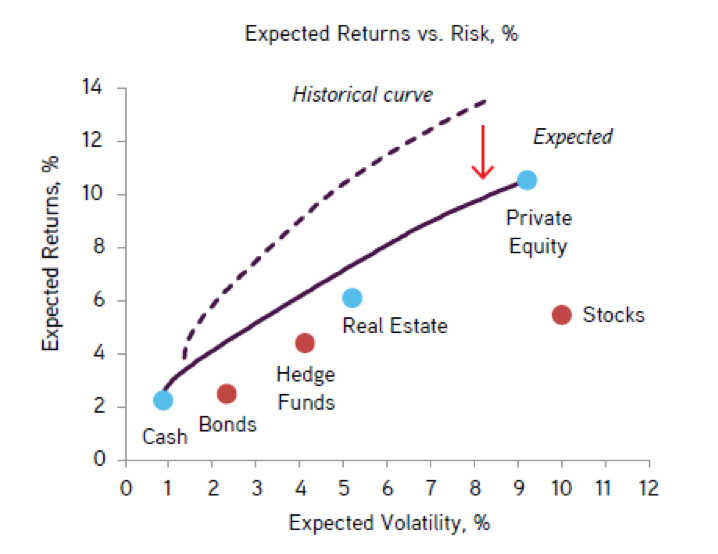

If you’ve been sitting on cash all year and are desperate to deploy some dry powder then I’d look at diversifying into other asset classes. Despite the fact that future returns will likely be below historical returns due to the shifting interest rate environment, I still believe that there are opportunities outside of public markets that will deliver solid returns.

Source: KKR, Cambridge Associates, Bloomberg

The one area that I continue to see opportunity in is private equity. As someone who is long a lot of cash, this is the one area of my personal portfolio (and my investors’ portfolios) that we are looking at actively to deploy further capital into while following Howard Marks’ famous mantra of “moving forward, but with caution.”

As the correlation between stocks and bonds continues to change (no longer negatively correlated) it is my belief that to survive any sort of market dislocation in the future, one must have a multi-asset portfolio that encapsulates many of the long-term structural trends that are relevant in the coming decade including the significance of Asia, millennial populations, emerging technologies and “new” industries such as cannabis.

Your hard-earned cash deserves the highest level of stewardship, so please start taking action before it’s too late.