Waiting Is Not Easy

“Bottoms in the investment world don’t end with four-year lows; they end with 10- or 15-year lows.” – Jim Rogers

Becoming a parent has been one of the greatest joys of my life in the last 5 years. It’s hard to describe what being a parent is like to someone who doesn’t have kids and in all honesty, I was never a “kid” person myself. I usually find kids annoying, especially when I get seated next to a crying baby on a flight…in business class. It used made me wonder what kind of parent I would be and I was admittedly quite apprehensive when my wife was pregnant with our first daughter over four years ago.

Fast forward to present day and three kids later (yes we’ve been busy) and I can say that parenthood can be one of the most frustrating yet fulfilling experiences of my entire life. Raising kids is certainly not easy but the amount of patience I now have for children is surprising, and one little smile or cute gesture is all it takes to make everything “worth it” at the end of a rough day.

I’ve particularly enjoyed watching my children grow up and enter their toddler years. Between the years of two and three the child’s cognitive development picks up and they start actually becoming a little human being, with the ability to control their baby/natural instincts and start making decisions on their own. I’ve quietly been studying the behavior of my children and can’t help but compare their behavior with that of the average retail “Mr. Market” investor.

Believe it or not, the parallels are uncanny.

One of the things that many children struggle with is the concept of delayed gratification. I’m sure you are all familiar with the famous Marshmallow Test. My children are no different. When they see something that they want, you can instantly see a physical change in their body language. Their faces change with a sense of urgency and they start jumping up and down in excitement and anticipation. There is no calculation of risk/reward…no. It is “I want this, and I want it right now.” And when I tell them that they won’t be getting what they want, they usually react in either sadness or a complete breakdown resulting in a full-blown temper tantrum.

Investors are just the same. Behind all the numbers and multiples and earnings reports, investor behavior and toddler behavior is one in the same. It’s basic and elementary and it leads investors, no matter how experienced or educated, to react the same way that a child would be given a particular opportunity.

Let me give you an example…

We all know that China is the second largest economy in the world right now after having gone through one of the greatest transformations in history over the last 20 years. China’s economy has grown by over 2000% and along the way, it has not only minted plenty of billionaires but also lifted the wealth of most of its entire population (rising middle class).

China also has the second largest stock market in the world. And as of right now more than 80% of the participants in the market are retail investors.

But according to brokers and stock picking gurus, that’s all about to change…

Last year, MSCI finally approved Chinese companies to be included in their emerging market indices. MSCI is the world’s largest index provider and more than $12 trillion of assets are regularly “benchmarked” against their indices on a daily basis. What that means is all the largest pools of money in the world (think largest ETFs, pension funds and endowments) who are benchmarked to the MSCI, will now have to buy Chinese stocks. And that 80% retail participation in Chinese markets will be drastically reduced and overtaken by institutional investors…

If my daughter was managing a portfolio right now she’d be all over this announcement. She would have piled in because of the headline news of the “MSCI rebalance” and the trillions of dollars of potential inflow into the A-share markets. Her greed would blind her from any rational thinking and the more research reports she read about this “seismic shift” the more urgency she would get to buy in before it’s “too late.”

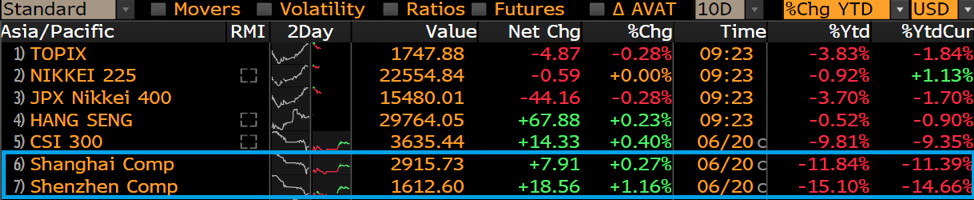

And she’d be looking at this right about now:

Ouch.

Clearly, this sort of move (MSCI inflow) doesn’t happen overnight. But you won’t believe the amount of sell-side research I received in the days leading up to the rebalance that claimed it would! Don’t be fooled by the mainstream media or stock promoters trying to get you to “buy China ASAP!” One look at what the A-Share index has done this year is all you need to realize that this is not an overnight event. China indices are down double digits across the board and anyone that came out of the gates guns blazing based on the news would be down quite a bit of money at this point…

What’s important, however, is to recognize the significance of this data point and the tailwind it will provide for investors over the long run. Remember the Marshmallow Test and remember second level thinking? As investors, we need to synthesize these data points and be able to think independently and critically about headlines, market timing, and reality.

Markets started off the week as if Armageddon was just around the corner. The trade war headlines once again caused markets to gyrate. As an active investor with somewhat of a value orientation, I was starting to get excited as many stocks were finally correcting from nose-bleed valuations to levels that I was more interested in owning them at. But of course, overnight we got a short squeeze led relief rally which trickled over into Asian markets which at the time of this writing are up a couple of % from their intra-week lows.

As I discussed last week, I’m in the business of active fund management. The mom and pop version of “buy and hold” investing is not in my game. As a professional investor I endeavor to print a double-digit absolute return regardless of what market conditions exist and to do so I have to run a number of strategies under macro portfolio to weather these choppy market moves. The macro allocation will always be hedged and it will include a broad mix of emerging market exposures, at the right price.

It is my contention that the market has yet to bottom and we are still early in this current correction. Relief rallies are common in the middle of larger corrections, and the markets are well away from being in oversold territory. Add in the fact that street wide bullishness is still at all-time highs (irrational exuberance), and the contrarian in me can’t help but believe this is consistent with a major market top.

In the coming weeks, I will delve into a little more detail on how I run my risk and hopefully, my readers will begin to understand how the essence of market timing, delayed gratification and embracing market downdrafts as potential buying opportunities. Investing, after all, is all fun and games until someone loses their money.