Gun to Your Head

“A hedge fund manager whose clients demand monthly performance reports has different needs than any individual investors with a 20-year time horizon.” – Barry Ritholtz

It’s a busy week in the markets and last week’s political instability out of Europe seems to be an all but distant memory. The week started out a bit rough with the G-7 meeting as Trump once again pulled his usual antics with Canada but he quickly redeemed himself over in Singapore at the US-North Korea summit which surprisingly went off without a hitch. Cooler heads prevailed during the historic meeting as Kim Jong-un stated that the “world would see a major change.” In first-ever meeting of a North Korean leader and a U.S. head of state, both parties signed a document that essentially confirmed Kim’s commitment to “complete denuclearization of the Korean peninsula.”

Whew. So far so good.

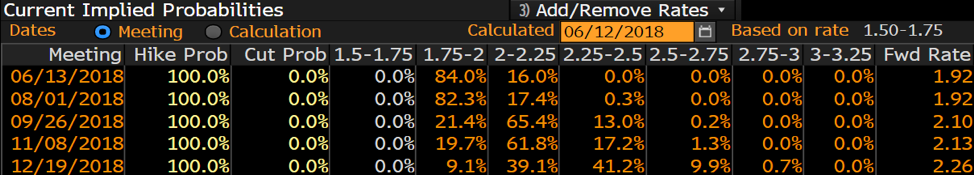

Now we just need to get through the FOMC, ECB, BOJ and US CPI this week and we’ll be home free. Wednesday is Fed day and as per Bloomberg’s probabilities, there is almost 100% certainty that the FOMC will raise interest rates another 25 basis points. It also seems to be a market consensus that this will be followed by another hike as early as September (rather than December) which will only further flatten the yield curve and bait a recession in the US. Indeed the base case assumption now is three hikes with the surprise risk factor being four.

Source: Bloomberg

Over in China, tech steals the headlines as Xiaomi (China’s largest private electronics and smartphone maker) wins approval for a Hong Kong listing and the company begins gauging investor demand as it prepares for what could be the largest IPOs in the last four years (analysts are valuing the company anywhere from US$70-92b.) Coincidentally, this announcement comes right after the company unveiled a massive US$1b loss in the first quarter, but hey…what’s a billy amongst friends? After all, isn’t that what we all love the most about tech companies? (Tesla/Snapchap/Twitter/Amazon etc)

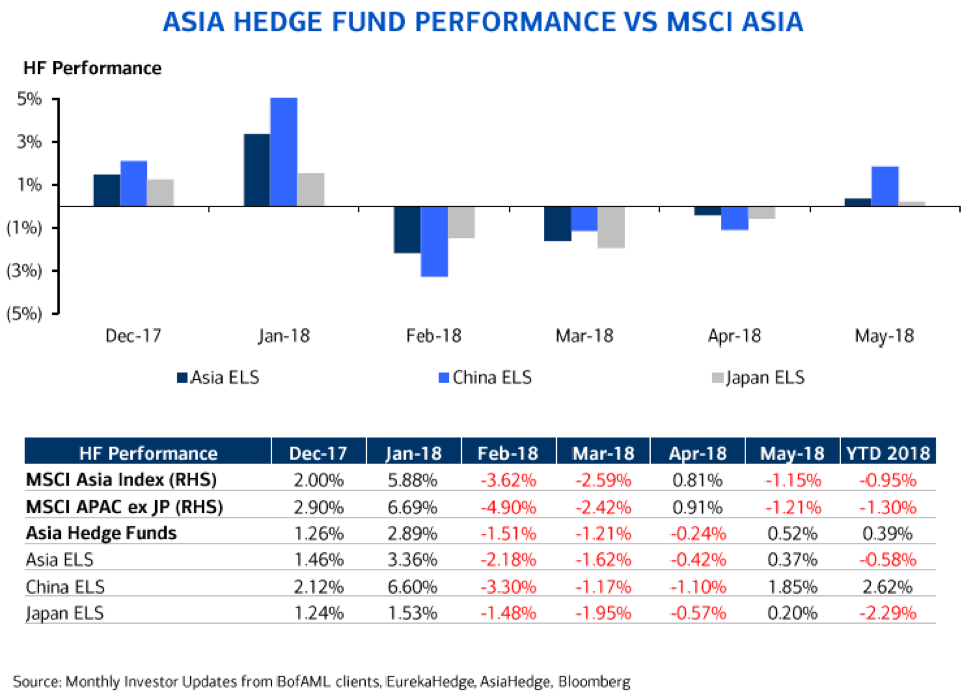

As I sit here and ponder our positioning going into the next couple of days, I can’t help but feel frustrated at the way this year has played out. It’s already mid-June and for all intents and purposes, hedge funds have vastly underperformed the various benchmark indices around the world (with the exception of China).

It’s very difficult to make money in a sideways trading market and as much as I love the TV show Billions (which just ended with an epic season 3 finale), I can’t help but wonder if Bobby Axelrod himself (main character/hedge fund boss) or even Taylor (Axe’s brilliant, young and gender non-binary CIO) could make money in this tape.

The very definition of a “hedge fund” is an unregulated pool of capital (usually from sophisticated or accredited investors) that aims to achieve “risk-adjusted returns” relative to a benchmark index. This outperformance that a fund achieves is called “alpha” in industry speak.

In layman’s terms what a hedge fund is, is basically a fund that a bunch of rich people pool together and elect an investing guru (or one that appears to be) to manage their money in return for a very high management fee and a percentage of profits. Hedge funds are “supposed” to vastly outperform regular benchmark indices so if you are wealthy enough and have an opportunity get invited to invest in one, you’ll certainly be better off than the retail investor, even net of fees.

And the rich get richer…or so the story goes.

Hedge funds generally charge “two and twenty” which is a two percent management fee for the assets under management and twenty percent of profits earned. Let’s stop and think about that fee structure for a moment. So basically, a hedge fund manager earns two percent on however much money is bestowed to them…no matter if they make money or lose money. Pretty sweet gig right?

So here’s where it gets interesting…

There are only two things that matter when you are running a hedge fund. The first is obviously performance. If your fund doesn’t perform then you have no business running a hedge fund. The second is AUM. AUM stands for “assets under management” and after I explained the management fee structure above, you now understand why AUM growth is of paramount importance to fund managers.

More AUM means more “free money” by way of a larger management fee, which takes the pressure off of performance since either way, the manager will get compensated. Sweet!. And if, by chance, the manager does happen to perform really well, then he gets a whopping 20% of the profits he generates — which if you do the math you’ll see how quickly it adds up and how hedge fund managers…well…become billionaires.

Sadly, it’s not all sunshine and roses in hedge fund land. The very set up of the way this industry works (which I’m sure had the most meritocratic intentions back when it first started) has turned into a greedy self-serving monster with little to no regard for fiduciary duty.

Managers, greedy for their “two and twenty”, find themselves being overly aggressive with their investing styles just trying to earn as much as they can (hey it’s not their own money, right?) And on the flip side investors of hedge funds have also become greedy… demanding monthly, quarterly and yearly returns often going as far as threatening to pull their capital if performance is unsatisfactory for even a quarter.

This creates an extremely dangerous negative feedback loop forcing managers to deploy capital with a gun to their head.

After spending the last four years managing an institutional hedge fund myself, I can tell you that there are A LOT of constraints to this model. We’ll all agree that the markets are abundant and there will always be opportunities to make money, but the timing of those opportunities is something that is beyond anyone’s control. So when you start having monthly reporting requirements, net and gross exposure limits, volatility and max drawdown measures, all of a sudden, investing becomes a lot harder at scale (talking hundreds of millions of dollars) than it does when managing your dad’s personal retirement portfolio.

What is the best investment advice I’ve ever given? It was in 2007 just before the Global Financial Crisis. My dad had just retired and had a bunch of cash to invest. Asian markets were on fire and everyone was telling him to BUY BUY BUY.

I said, “Dad, do nothing.”

It saved his savings. Sometimes the best thing to do is nothing…which is a luxury most active managers do not have.