This Time is Different

“When China speaks, foreign governments listen. When Trump tweets, they find a senior US official to check whether he really meant it.” – Edward Luce

Lately I’ve been noticing a chorus of investors, academics and financial pundits jumping on the “emerging markets are screwed” bandwagon. The latest to jump on the bandwagon last week was none other than Paul Krugman, the Nobel Prize-winning economist who took to Twitter to express his view that there is a storm brewing akin to a 1997-style Asian Financial Crisis.

For those of you who remember, the Asian Financial Crisis was a series of emerging market currency devaluations which started from Thailand that led to a sweeping market selloff and raised fears globally of financial contagion. It began innocently, as all great financial crises do, with a sustained period of strong economic growth which inevitably leads to asset bubbles financed by foreign direct investment and heavy debt. George Soros, who had just five years earlier “broken the Bank of England” by shorting the GBP, was back in action again shorting the Thai Baht and reaping a windfall at the expense of others. In the end the IMF ended up stepping in with bailout packages to help stabilize the weakest Asian currencies.

I still remember hearing about one of my cousins who was working for a large US bulge bracket bank at the time, getting tangled up in the whole mess. He had been one of the top producers of selling structured Thai products to his institutional clients and at the pace he was producing at midyear, he was almost guaranteed to make Managing Director at year end (and get paid a huge bonus).

Sadly, the crisis unfolded and his entire desk took the brunt of the blame. What looked like a guarantee for my cousin into the promised land just a few months earlier, quickly became his worst nightmare as the bank was hit with a slew of lawsuits and redemptions amidst the panic of the crisis. My cousin was subsequently offered up as the sacrificial lamb for the entire team and was out of a job by the end of the year and virtually unemployable thereafter.

Now my point in sharing that story wasn’t to be a Debbie Downer, but rather to remind us that these types of stories do exist and no one can be 100% protected or insulated should financial contagion strike again. It also serves as a gentle reminder for us to ensure we are investing with the right frame of mind.

You’ve heard me preach on before about the importance of maintaining a mindset of capital preservation versus one that is solely opportunistic and as the world goes deeper and deeper into the rabbit hole of credit, profit, financial engineering and technology, it is easy for us to lose sight of what investing actually is.

Cryptocurrencies are a perfect example of how the definition of “investing” has changed to simply being the act of buying something now that can hopefully be sold later, at a profit. Most investors will agree that this is not investing but speculating. But does that mean the profits that are earned by these so called speculators are not real as well? The Lambos they are driving around seem pretty damn real to me…

What ever happened to good old investing in real businesses with actual revenue?

The fact of the matter is that whether it is investing or speculating, each and every individual must determine what the right risk tolerance is for themselves. We all know how hard it is to earn money and make an honest living. As soon as the monthly paycheck hits the account, most of us have already spent it. Our nest eggs take years, if not decades, of hard work in the system to save up for, and we don’t get very many “at-bats” to make money. This is why at the risk of being redundant, I always come back to the importance of asset protection and capital preservation.

But let’s get back to emerging markets for today. To be clear, I don’t believe EM is out of the woods just yet and risk conditions are indeed deteriorating, but the setup this time around is markedly different than what went down back in 1997. When considering emerging markets it’s important to note the relationship EM has with the US Dollar.

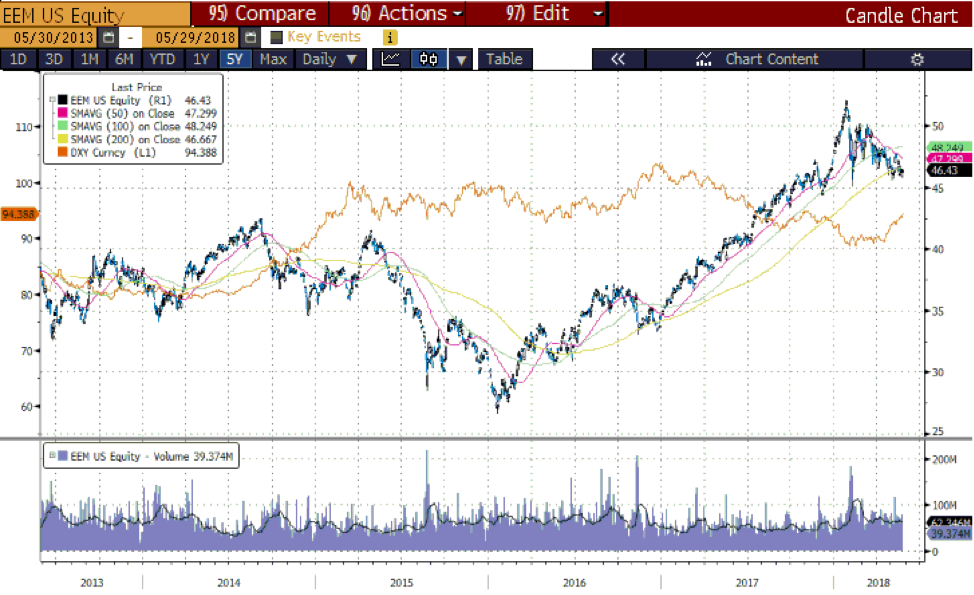

EM fund flow is largely dependent on the strength (or weakness) of the US Dollar and the interest rate cycle. One of the largest agenda items of the current administration in the US is the goal of having a weaker dollar which would help balance the trade deficit by ensuring exporters did not have a strong native currency. In short, a weaker dollar is good for the US when it comes to trade and foreign opportunities. And in turn, when the dollar is weaker, emerging markets do better and vice versa.

EEM vs. Dollar Index (in orange) – Source: Bloomberg

However, the opposite is also true. When the US dollar is stronger, whether it be due to a stronger economy or rising yields to combat inflation, the cheap fund flows moves out of EM which could potentially cause a downward spiral in those particular emerging market currencies. These moves can be violent and quick as no institutional investor wants to be the last one holding the bag.

So where does that leave us today?

Indeed, emerging equity markets such as India and Indonesia have fallen sharply in US dollar terms since the USD began its rally in April but again, this isn’t 1997 all over again…at least not yet. Most of you know that I am long-term bullish on Asia and EM so any pullback in these markets is a buying opportunity in my mind. We are 2 days away from the “event of the week” being the MSCI rebalancing at the close on May 31st. The largest net inflow will be coming from China (to the tune of US$6.09b) as it strengthens its position on the world stage. The impact is much more gradual than immediate but the profound impact will be overall and around investor mentality and appetite as we witness the continual liberalization of the Chinese markets.

The seismic shift is happening right in front of our eyes…are you ready for it?