Shots Fired

This past weekend I took my wife and 2 daughters over to Macau. Macau, which was once, quite frankly, a run down, decrepit sh!thole… has actually progressed by leaps and bounds since the large foreign casinos began investing heavily there over a decade ago. My family and I actually had a great time and we enjoyed a lot of child friendly activities in the little Portuguese territory that only used to offer adult friendly activities. I was able to unplug at least for a day or so completely from the mayhem of the markets and enjoy some quality time with my kids.

Investors this week came back to an overall risk off environment after the long Easter weekend as heavy volumes in the US dragged the S&P below the 200 DMA. While the tech complex has been the obvious whipping boy for the last couple weeks, this time the selling was non discriminate and across the board.

Asia was a flurry of follow on activity today as the “sell first, ask questions later” mindset took over in this short holiday week. Hong Kong is on holiday tomorrow for the annual Tomb Sweeping holiday and China remains closed Thursday and Friday, which always leads to profit taking by investors.

Markets started off looking firm this morning but by mid afternoon the Heng Seng Index broke below the key psychological 30,000 level as the trade war once again reared its ugly head. First came the Trump administration announcing a further $50b worth of tariffs on China imports followed by return fire from China threatening reciprocal tariffs on 106 various U.S. products.

Source: Bloomberg

By the way, if anyone is actually interested, here is the detailed list of the 106 items (in Chinese) which basically cover soybean, wheat, corn, beef, autos, airplanes, tobacco and chemicals.

“Ten Sense”

China’s internet is owned by the “Big Three” internet companies Baidu, Alibaba and Tencent or BAT (like FAANGS) for short. (Facebook and Twitter are banned in China and Google chose to withdraw due to censorship restrictions). Due to the explosive population and technology growth that China has seen in the last decade, the country has become the largest internet market in the world.

Tencent Holdings Limited is a Shenzhen-based Internet holding company that owns a variety of digital media, entertainment and communications subsidiaries. Most notably, it owns WeChat, the increasingly-dominant Chinese mobile chat services, as well as Tencent QQ, the country’s popular instant messaging platform, and QQ.com, its leading web portal. Its Tencent Music service currently boasts more than 600 million active users and it’s the world’s largest and most profitable music streaming service.

Tencent’s WeChat is the equivalent of Facebook + FB Messenger + WhatsApp + Tinder + Paypal + Slack (business messenger) all combined together. WeChat is used by 79.6% of entire population and more importantly, China has surpassed the west particularly in the area of mobile payments.

Since 2014, China’s E-Commerce market surpassed the U.S. for the first time in history. The majority of the online consumers in China don’t even carry a wallet anymore and transact almost exclusively via mobile payments on their phone. Tencent (WePay) has 37% market share in mobile payments and Alipay (Alibaba) owns 54% market share.

Tencent (which local Cantonese like to pronounce as “Ten Sense”) is the darling and bellwether of Asia. It’s the second largest constituent in the Heng Seng Index, the sixth largest publicly traded company in the world (bigger than JP Morgan and Berkshire Hathaway) and it has made many people very rich over the last decade as the stock price seemingly only goes one direction – up.

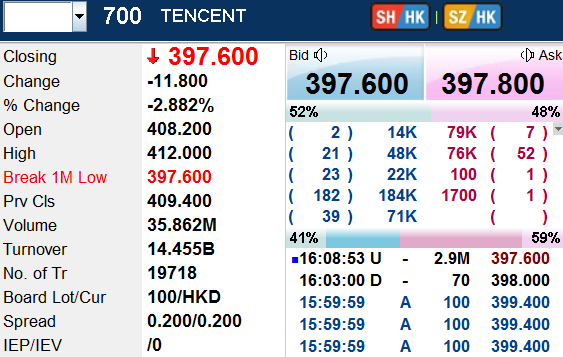

Source: etnet

Today Tencent closed below HK$400, at HK$397.60…a closing level we haven’t seen since December of last year.

The amazing thing is that no one actually knows how to value this company. Even below 400, the company still trades on roughly 19x FY19 EV/EBITDA (Facebook trades at around 10x). I asked a few friends on the street where they would “be a buyer of Tencent” and the best answer that I got was “HK$388…cause that’s a lucky number” (8 is the most auspicious number for Chinese).

Right on!

Only time will tell how long the knife will fall on this one, but without an accurate gauge of fair value, it’s probably best not to be a hero right now.

Who will be left holding the bag?

Last month market the ninth anniversary of the current bull market. Maybe it’s just me but if I’d been brave enough to be playing chicken with risk on in this market, I’d be looking for any excuse to sell right now.

In case you’ve forgotten the handful of excuses available out there, here is a non-exhaustive list of them, in no particular order:

- Late cycle rich valuations across the board

- Quantitative Tightening

- Record debt levels

- Trump’s trigger happy tweeting

- White House staff musical chairs

- Tariffs and Trade War

- Facebook Fiasco

- FAANGS vulnerability

- Tesla

- Heightened volatility

I fully anticipate a rough rest of the week for us. That all said…is the glass half empty enough for you now?