Another Day, Another Dollar

“If it were possible to take interest rates into negative territory, I would be voting for that.” – Janet Yellen

Another week goes by and equity investors have locked in another week’s worth of profits. We’ve drifted well into no man’s land at this point and I’m starting to wonder if it’s just me that has gone bat shit crazy feeling this paranoid about the markets each day.

At the core of investing, beneath all the numbers and fancy industry jargon, lies human emotions which tend to be the one variable that has the greatest effect on an investor’s success in the markets. The psychology of an investor and the ability to control one’s emotions is was separates the retail spivs from the investing legends.

Sure, it’s easy for everyone to remain calm during times of low rates and prosperity as we’ve witness for the last 8+ years, but as soon volatility rears its ugly head (as it has a few times already this year) emotions get the best of people and they start doing irrational things.

Source: Bloomberg

As we try to digest newsflow and market noise, while maintaining an independent and often times non-consensus view of the market, it’s never been harder to navigate this in this red ocean.

Why? Our brains have a way of taking the shortcut when it comes to assessing risk and this more often than not this leads to incorrect decision making.

Cognitive biases were first introduced by Amos Tversky and Daniel Kahneman in 1970s and for those who are curious to learn more I’d highly recommend Kahneman’s best selling book Thinking, Fast and Slow for an in depth study.

I always like to gut check myself and my cognitive biases that tend to arise during times of excessive greed (like now) and excessive fear (like in the middle of a market crash).

Let’s take a look at a few of my personal favorites (there are tons) and review how they could be affecting our investment decisions in this market environment:

- Bandwagon Effect. Let’s start with the most obvious one here which is basically exactly what it sounds like — people jumping on the bandwagon because others are doing it, regardless of their own beliefs. I call this the FOMO effect and we’ve seen this time and time again during the peaks and toughs of the market. Right now nearly every asset class (including crypto) is frothy but everyone also knows that the largest gains of a bull market run are made at the very end. So they keep piling in. Or maybe they don’t even know that, but are simply jumping on because everyone else is.

- Anchoring. This is one of the hardest for investors to recognize and ignore and it basically describes a person’s tendency to anchor all future perceptions and decisions based on an initial piece of information which gets weighed too heavily in their mind. Let’s say you hear about a hot new startup that was recently endorsed by Elon Musk on a random tweet. You’d anchor and filter all future information about that company based on the fact that Elon Musk endorsed it and let that outweigh the potential negatives of “what could go wrong.”

- Confirmation Bias. This leads us right into confirmation bias which can oftentimes occur right after anchoring. I like to call this the “lens effect” and it is the tendency to view all future information about an investment through the lens of your initial bias. “I think Bitcoin is a good buy” can lead you down a dangerous path of skipping over all the negatives articles about it and only reading the positive ones.

- Choice-supportive bias (aka post-purchase rationalization). Everyone hates being wrong, especially when money is on the line. This one is particularly relevant for investors who tend to become even more tunnel visioned once they have “skin in the game.” This makes the case for trading rules such as stop loss limits.

- Gambler’s Fallacy. I call this one the “contrarian’s curse” and it is a person’s bias believing that when something happens more frequently than normal during a given period, it should happen less frequently going forward (like betting on the opposite color in roulette). This tends to affect day traders and stock screeners a lot who try to bet against the trend based on a number of technical or fundamental valuation metrics. It also leads to short term trades being long term holdings when it doesn’t go the right way (old investing joke).

- Illusion of Validity. Also known as “classic finance dbag syndrome.” This is a bias that many finance professionals have causing them to overestimate their ability to analyze data or make investment decisions. This is why it is much better to have an investment team that can look at opportunities together, challenge each other’s views and come up with a robust consensus investment thesis as opposed to operating as a one person band.

Tricky, eh?

It’s important to note that we all have cognitive biases and while many actually do help us make correct decisions, it is acknowledging and identifying our shortcomings that help us balance them out in our minds. This in turn helps as we build conviction in our investing.

And all we have to do is manage these little demons in our heads…

Hold The Line

It’s been well established that the era of low volatility is long gone by now. One of the main causes of this low volatility has been the Central Banks and their decade of low interest rates.

Low interest rates created an environment that encouraged risk and the cheap cost of capital helped encourage corporations spend an exorbitant amount on share buybacks, which has subsequently inflated EPS growth.

It’s like taking out a cash advance on your credit card (at a super low rate) to make your bank account look bigger.

As we sit here awaiting the upcoming US Inflation number tonight with bated breath, I’m sure you’ve been noticing the heightened market sensitivity to “newsflow”. An increasing number of traders recognize that bad news actually matters, and now anything no matter how great or small, appears to have the power to spark a powerful sell off.

Economic momentum in in full gear and the threat of inflation is a lot larger than what most people choose to believe. An accelerated rate hike cycle is just about all we need to trigger a bandwagon effect of panic selling.

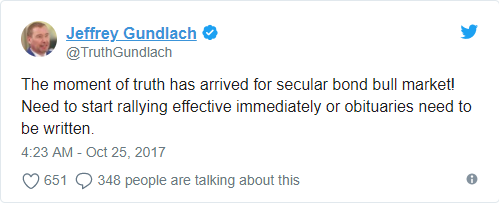

Source: Twitter

As Gundlach pointed out, keep an eye on the 3% bond yield level folks, it’s going to be an important one in determining the beginning of the end.