Wakey Wakey

“Anything you do is going to be wrong, including nothing.” – Henry Kissinger

For the last few years markets have pretty much been one giant snooze fest. Around once or twice a year in the last four years there’s been a “risk event” that got the blood flowing.

In 2015 we had the Swiss Franc devaluation followed by the RMB in August. In 2016 we experienced Brexit and 2017 was the Trump surprise victory.

There were of course many smaller events along the way but these are the ones that stand out in my mind.

2018 will be remember for…a strong non farm payrolls print???

Just like everyone out there with risk exposure, I’ve been trying to wrap my head around what exactly happened this past week, and more importantly which direction the market will end up going from here on out.

And just like everyone else out there (regardless of what they say) I have no f&*king clue.

Every morning this past week I woke up around the time the US markets closed and while still half awake would check to see what color the “World Equity Indices” screen was showing.

My eyesight is usually still blurry that early in the morning but it didn’t matter because all I cared about was the overall color: green or red.

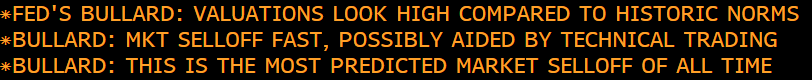

On Wednesday morning I rolled out of bed to this garbage:

Source: Bloomberg

Vomit.

I mean talk about annoying…everyone knows hindsight is 20/20. But come on…the last line? Was that really necessary? Do you think that everyone forgot that it was the Fed who started this whole f&*king mess to begin with 8 years ago?!

After his speech he then took to a news reporter to further pontificate on the state of the markets.

“So it is probably not surprising that something that has gone up 40 percent like the S&P tech sector would at some point have a selloff. Before there was a selloff, people said repeatedly someday this will sell off.”

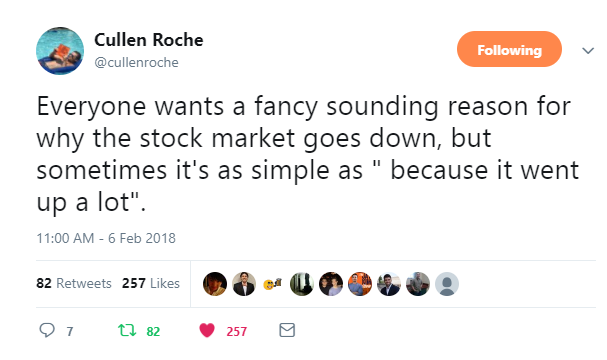

What value have you added with that statement? I personally think Cullen Roche said it more eloquently:

Source: Twitter

We’ve had pundits galore come out of the woodwork in the days following the sell off, on each side making arguments for why this is either just a blip or the beginning of the end.

With each one of these “pontification”s the market tends to go up and down the rollercoaster track, which is also telling of how jittery investor sentiment is right now.

A Return To Innocence

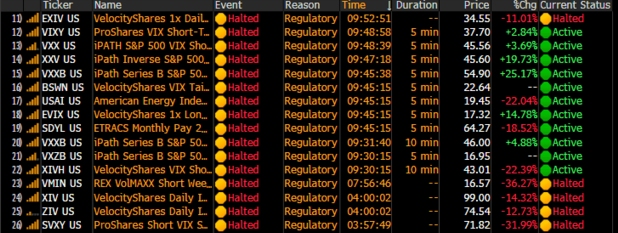

One of the big stories of the week was Credit Suisse’s redemption of their Short-Vol ETF XIV. For those of you who are unfamiliar with what the XIV is, it is essentially a tool created to be able to profit off of the low levels of volatility we’ve seen for years now.

We’ve spoken before about the VIX and how it’s artificially suppressed levels have been a big source of concern for many investors.

For anyone that’s tried to trade vol on the non-futures level (using ETFs such as VXX) you’ll know that VXX has negative carry and its inverse the XIV has positive carry.

What this means is that if you buy the VIX expecting the market to blow up “sometime soon” you have a cost to pay, every…single…day. And trust me…it sucks. It’s a slow bleed and usually not worth it.

What this also means is that if you do nothing but just buy and hold the XIV (short vol), you will magically make money every single day…until you don’t.

A couple weeks ago I pointed out the tandem moves of the VIX and the S&P that we witnessed in the market and how that made me even more paranoid about current valuations and global market risk.

This week was the day of reckoning where we saw the VIX skyrocket up past 50 as sentiment deteriorated around the world.

When the news broke about the XIV plunging 80%, the first thing that came to my mind was just how many people were short volatility (that shouldn’t have been) since it was seemingly the “layup trade of the decade”.

The second thing that came to my mind were scenes from the movie Margin Call which depicted the lead up and contagion that spread during the financial crisis. How bad was this Credit Suisse redemption? What were the implications of this vol spike? What about all the other “short” vol instruments out there at the various institutions? Could this be the beginning of the end?

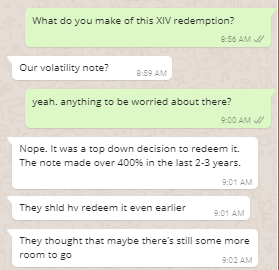

I quickly texted a close friend of mine who is very senior at Credit Suisse:

I trust my buddy an all, and apparently it was hedged exposure, but I’m still a bit skeptical. I spent the rest of the morning looking up all the other short vol funds out there that might potentially get redeemed as well.

Source: Bloomberg

The bottom line is most people who were cherry picking the “free” short vol trade finally had to pay for their ride.

As my friend and former Lehman colleague Jared Dillian mostly aptly put it:

“XIV did exactly what it was supposed to do—make money for six years and give it all back in one day. That’s short vol.”

Alright smart guy, so now what?

If you’ve ever sat on a trading floor before you’ll probably have heard the term “smart money” being tossed around by traders and salesmen.

“Got some smart money coming in to buy the dip here….”

“The book is 3x oversubscribed…mostly long onlies but a few smart money guys in as well…”

Smart money here refers to “hedge funds” who over the last few years have ended up getting a pretty bad rap due to their high fees and underperformance.

A lot of hedge funds were caught snoozing during this sell off and at the risk of eating my own words after this mini rout runs its course, I wholeheartedly believe that volatility is back for good now and the roller coaster we’ve seen this past week will be the new normal going forward.

As the era of coordinate central bank action comes to a close, the Fed will continue to unwind its balance sheet and focus on it’s own backyard first.

The US is at risk of seeing inflation due to strong underlying fundamentals and we know for a fact that rates are only going one direction from here.

The silver lining is that historically heightened volatility is always favorable for emerging markets.

For those investors who have not yet taken chips off the table in developed markets, now would be as good of a time as ever to start. While we most certainly may have a better exit opportunity than levels seen this week in the short term, we can rest assured that this won’t be the “bottom”, and that much is guaranteed.

Astute investors who’ve taken some chips off the table will soon be presented with a golden opportunity to increase exposure to emerging markets.

Patience will pay off in the end.

As the great Howard Marks so aptly put it, “It’s better to turn cautious too soon rather than wait until it’s too late.”