Wading In The Velvet Sea

“…the packaging begins to break, and all the points I tried to make, tossed the thoughts into a bin, time leaks out, my life leaks in…” – Phish

One of the joys of attending a large state university (in addition to the obvious Division One sports that I was able to enjoy) was Greek life. It may sound strange to you to hear that I was part of a fraternity in college, and quite frankly it still sounds strange to me as well.

This wasn’t some Asian fraternity either, it was a proper national social fraternity called Chi Psi, with chapters in over 30 states across America.

It was never my intention to be in a fraternity. But it just so happened that one of my closest friends from my high school years was a brother at this house and he “recruited” me to meet some new people on campus when I arrived.

Lo and behold, a few months later, I was initiated into the brotherhood.

I spent my first semester as a new brother living in the actual fraternity house. It was all I could handle and I knew that if I didn’t move out, I’d risk failing out of college. My roomates at the time were huge Phish-heads and actively followed the band all around the country to attend their sold out concerts.

The crowds at these concerts were a sight to behold. Most of them were the tree hugging type, and they almost always were were drunk or high for the duration of the concert. But the most fascinating part of this herd was that during those 3 hours that was that nothing in the world could bring them down from the elated state they were in.

Until the lights finally came on.

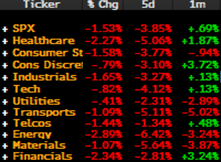

The last 48 hours has been a flurry of market activity. My screens were a sea of red for the last two days and despite the pain that was felt world wide on this pullback, I have to admit, it’s been fun.

Not fun in the “I told you so” sort of way but fun in that these sort of pull backs always present opportunities for smart investors to differentiate themselves from the Phish head masses.

The Everything Crash

It all started last Friday after a strong payrolls print. This manifested itself in inflation/rate hike expectations, yield curve steepening and broader commodity weakness. By mid session Friday, it was clear that the volumes and moves seen in the US were “different this time”. The Dow plummeted an eerie 666 points which prompted my boss to send me a text at 1:30am Hong Kong time:

“This is bad. We need to talk ASAP.”

Source: Bloomberg

All 11 sectors in the S&P dropped together and so did bonds, commodities and even cryptos (partly for other reasons but also partly due to broad based sentiment).

Suffice it to say that this was NOT what anyone was expecting.

No credit blow up, no exogenous or geopolitical risk event, just simply and unsuspectingly…strong economic data.

Monday Funday

Monday morning in Asia was a follow-on of bloodletting. As investors fully digested the newsflow over the weekend, the natural stance was risk off going into Asia trading.

Sentiment started getting worse during trading hours but surprisingly, the Yen did not break down (strengthen) just yet.

Perhaps investors were hoping it was simply a stutter step.

China didn’t hesitate to BTFD (Buy The F#$%ing Dip) and fund managers actively embraced the correction by jumping all in on Hong Kong listed shares of banks, airlines and insurers.

By Monday night, it was full risk off in the US markets. Futures sold off fast and furious and Treasuries actually caught a bid at the 2.79% level. The VIX spiked well past 35 and the risk reduction was more broad based and indiscriminate than last Friday’s. Market volumes were through the roof with ETFs accounting for over half the total.

In the wee hours of Tuesday morning the Yen finally capitulated and caught a safe haven bid breaking below 109 which of course caused the vicious sell off this morning in Japan.

Bitcoin? Nah. Guess again — The VIX. Source: Bloomberg

By the way, remember the Trade Of The Year we spoke about before? This gift that kept on giving finally ran out and the XIV exchange traded note plunged 85% in the after hours session. The scary part was that Credit Suisse (who was the creator of this instrument and largest holder) was down over 6% in after hours trading as well!

Where do we go from here?

I detest “I told you so’s” but it is clear that greed has outrun fear at this point. From the joys of tax cuts to suppressed interest rates, the 8+ year bull market run we’ve enjoyed is finally taking a breather. Here’s the thing:

Market corrections are good for us. They are healthy for the overall financial system.

This might look like the beginning of the end but this certainly isn’t a “major correction”. What this is, is the beginning of a return to normal. A normal where volatility picks up again and pullbacks like this become a “regular” part of the ebb and flow of stock markets.

Let’s not forget that we are sitting 7 months from the longest bull market run EVER. (And c’mon…how fun is investing if the market only goes one direction?!)

We are well into the late stages of the growth cycle and what that means is that investors care much more about economic momentum than margins (which should already be above the long term average).

When we digest the clarity on the Fed, who was once the tide that helped lift all boats, we now find ourselves at an inflection point of having to worry about the interest rate cycle much more than ever before.

At some point in the tightening cycle, yields will just be too attractive to ignore which will pull investors out of risk assets and back into bonds.

No matter what you call it, what was evident in the last few trading days was that in the early stages of a risk off move like this, asset classes move like herds…indiscriminately.

The next 24-48 hours will be very telling of how deep the risk moves will take place. The moves we’ve seen up until now were mostly a de-risking and net reduction exercise across the board. The question remains if we will see gross exposure de-risking in material size.

I full believe we will see further pull back at some point in the next few trading sessions (beware of the dead cat bounce) but I don’t actually believe we are entering a severe bear market by any means.

If you’ve done your homework ahead of time, you’ll be embracing market dislocations such as these to cherry pick good companies at fair prices.

Keep calm and invest on.