When There’s Blood In The Streets

Yesterday marked the 30th anniversary of Black Monday.

After peaking in August of 1987, the Dow suffered the single largest one day percentage decline of 23 percent.

It was a true Gotham’s Reckoning moment. Massive capital was lost on this day by feeble investors who chose to abandon ship, capitulating just before a bottoming out of the markets. If they had only held on a little bit longer, the blood letting may not have been so severe.

Investing, at its most fundamental level is about human psychology.

The pain felt when having to endure a 23 percent drawdown is excruciating and many would rather take permanent losses and be “out” than have to endure another trading day in hell.

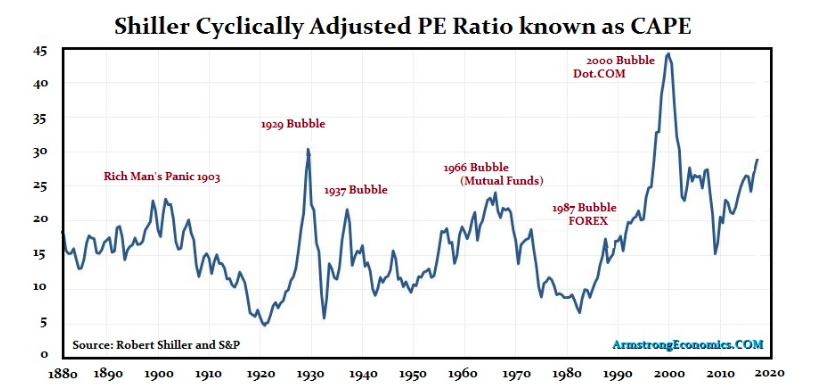

By nearly every valuation metric in the world, current markets are overpriced. One of the most popular gauges out there is the cyclically adjusted price/earnings (CAPE) ratio which was devised by Nobel Laureate Robert Shiller back in the 80’s.

The CAPE, which is based on average inflation-adjusted earnings over the trailing 10 years, stands at 31, versus the only other two times in history it was higher — 32.5 just before the crash of 1929 and 44.0 in late ’99 prior to the dot com bust.

Source: www.armstrongeconomics.com

The consensus of investors is that artificially suppressed interest rates warrant high valuations.

Even the legendary Warren Buffett recently came out saying that interest rates are akin to gravity for the stock market and valuations are “reasonable” if interest rates remains low.

Human psychology controls the mind of the investor at a level so deep that often times we miss all the warnings signs because we are fixated a number of powerful narratives embedded in our minds.

One such narrative is the optimism around the Trump administration lead by his pledges to cut taxes and revive the economy.

Another such script is one that is fear induced from the rise of Artificial Intelligence and robotics. Out of fear or desperation that the world will reach singularity sooner rather than later, investors have piled into FANGs and tech stocks, perhaps hoping that their market gains will be useful when judgement day finally arrives.

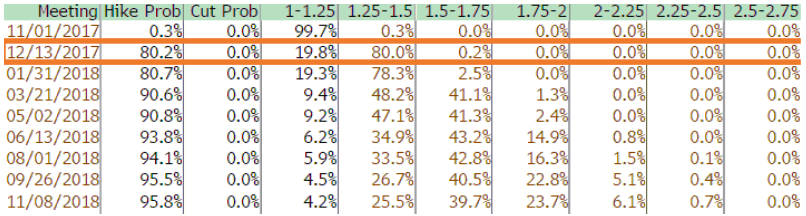

The elephant in the room remains that the probability of a Fed rate hike before year’s end (Dec) is now up to 80% and only time will tell what the unwinding of a nearly $4.5 trillion balance sheet will actually do to our gift that keeps on giving.

Source: Bloomberg

Back in 2013, when Fed Chairman Ben Bernanke suggested that they should reduce the pace of treasury and mortgage backed security (MBS) purchases in the future, the episode, which we now dub the “taper tantrum,” resulted in the 10 year yield jumping from 1.94% in May 2013 to 3.04% by the end of the year.

Fast forward to today, the Fed has lifted interest rates three times since December 2016 and announced the unwinding of its $4.5T balance sheet to begin in October 2017, yet 10-year yields have actually fallen from 2.5% at the beginning of the year to 2.3% today.

In other words, the market, which was once so easily rattled by the mere suggestion to slow the rate of Fed purchases, has now actual grown giddy at the prospect of a shrinking balance sheet. Huh?

Even after Federal Reserve Chairman Janet Yellen announced the unwinding of the Fed’s $4.5T balance sheet to begin in October, her comment that the pace of unwinding will hopefully be as uneventful as “watching paint dry” was taken at full face value.

What to do?

At this point in the cycle a perplexed investor can 1) go all in on this late stage rally by leveraging up to juice returns, 2) take on riskier assets such as the 7.9% yielding 100-year bond of Argentina which has defaulted 8 times in its 200 year history, 3) speculate in unconventional investments like Bitcoin and other digital currencies or 4) color up, hold cash and go into full doomsday prepper mode.

The common denominator for all but the last of the strategies listed above is that although they call for commensurate risk, it appears the fear of missing out (FOMO) has cancelled out what should be the greatest fear for an investor — the fear of losing money in the market.

Astute investors will know that one of the smartest ways to diversify risk is to overcome the “home country bias” that most US based investors have and look to deploy capital abroad.

Now would be precisely the right time to do this.

Looking to Asia, the highly anticipated event of the week was the twice a decade “meeting of the minds” that we discussed previously, which started in Beijing.

The opening speech which was given by President Xi was akin to the annual “State Of The Union” address that the US President gives each year. Eager listeners often use this speech to analyze and project the political dynamics and policy priorities that will follow in the next five years.

As expected there were no major shifts in policy direction but rather President Xi stressed the longer term goal of developing a modern socialist society as China has entered a “new era of socialism” where stagnant development sits at odds with “people’s ever-growing demand for a better life.”

President Xi even went as far as to say that the government is committed to achieve “a moderately prosperous society” by 2020.

As China aims to transition from an investment driven economy to a consumption driven one, several key thematics stand out which fall directly inline with the country’s broader mandate:

- Upgrading the manufacturing sector from low-end, labor intensive to high-end

- Encouraging technological innovation as a primary driver of economic development

- Promotion of “green” growth and environmentally friendly best practices

Savvy investors will be able to capitalize off of all three of these government backed initiatives by rotating into Asia while at the same time de-risking their highly overvalued US equity holdings.