I Feel Like I’m Taking CRAZY PILLS!!

“Central banks are losing control and they don’t know what to do … just like the Republican establishment and Donald Trump.” – Jeffrey Gundlach

The world is in a dysfunctional place right now. Between the recent college admissions scandal, MMT and this entire socialist movement (don’t even get me started) and the overall market outlook for this year, there’s a lot that I could talk about today that I’ll choose not to get in to. That includes the platter of potential risk events we have been kindly served, all of which make for great conversation topics (Brexit, North Korea, China, Boeing’s 737 MAX’s, terror attacks in New Zealand). But I’m not going to talk about them today, mostly because I don’t want to get into a huge political rant about how doomed I think our government is. We’ve had enough grief over the last 3 years dealing with our current Commander-in-chief so let’s take a breather and just stay in our little corner in the back of the room called financial markets.

Between September of last year and Christmas Eve, the S&P sold off nearly 20%. The downdraft was violent and caught many investors, including myself off guard. Doom and gloom stories proliferated the headlines of mainstream media and even Trump chimed in from his usual peanut gallery on Twitter, berating Fed policy for raining on the market’s parade.

But even more surprising was the magnitude and speed of this January’s rally. Fed Chairman Powell folded like a lawn chair to the markets and in the month following the December FOMC meeting, the Fed had masterfully 180’d their policy stance from hawkish to uber-dovish. It was by far the sharpest policy U-turn I’ve ever seen in my professional career as an investor and by the time investors had caught wind of the rally, the Dow was already up over 6% for the year.

The market euphoria wasn’t just restricted to US markets though – China’s indices are up nearly 30% year-to-date as both retail investors and institutions piled into the trade believing that a trade deal would finally be achieved. The bullishness was so manic in fact, that all the hot sectors related to 5G, brokerages or even companies that simply had the word “securities” in their name were pushed to their limit up prices by the end of Feb.

And yet despite this rip-roaring bull market, the Fed has come out and slipped in a few nuggets that most market spectators might have missed. It’s become somewhat obvious that the Fed is now at the mercy of the market and not the other way around which makes me wonder why they would come out dropping phrases like “tools to combat any further downturns” and this entire notion of capping Treasury yields. Check out what Fed vice chair Clarida said at the end of Feb:

“It will also review what new tools it might use to combat any future downturns, including tools that it rejected during the most recent crisis like capping Treasury yields as part of a bid to lower borrowing costs.”

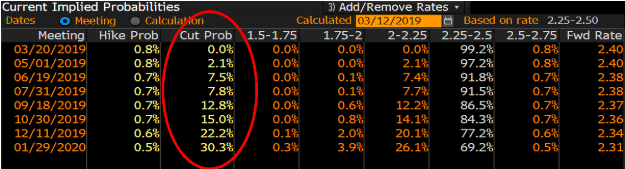

Now let’s see what the market thinks about all of this. I pulled this off my Bloomberg, its a screen called WIRP (World Interest Rate Probability). The screenshot below is for the Fed Funds Futures:

Source: Bloomberg

Like I said…the fastest policy 180 that I’ve ever experienced! We basically went from three hikes this year down to zero, with a third of the market believing there will be a rate cut by early 2020.

I’ve said this before and I’ll say it again, bond traders are the smartest traders in the markets. Bond yields tell the true story of market expectations on inflation and real interest rates, which is why the yield curve is so important for us to monitor. The yield curve always flattens when the Fed raises rates (and steepen when they cut rates) which puts us smack in the conundrum we are in right now, with a dovish Fed and the fact that we’re probably months away from a recession right now.

Okay, so the million dollar question is how the hell do we trade this market right now?

The FOMC meets later this week for a policy decision but at the end of the day, most investors are nearsighted. With no signs of recession in the immediate future, most are bullish right now on stocks and the economy, particularly in an election year. You can be as contrarian as you want to be but right now it seems that despite all the worries out there about a slowdown in global growth, the market is more worried about the rate of inflation than anything else. Take it for what it’s worth.

I’m sitting at the short end of the curve, in precious metals and cash. I’m still not in equities (yes I missed out on a big portion of the rally) but I also wouldn’t short this market either right now…not yet. If we get a rate cut the yield curve will steepen at a pace that is in line with Fed activity. But with two’s paying 2.47% and ten’s paying 2.62%, it just doesn’t make any economic sense whatsoever to go further out the yield curve. At least not in the scale of my small private portfolio.

And as for the market outlook for this year goes (though we all know that it’s a fool’s errand to try and predict these things) I’m of the view that Trump will get a deal done with China, diffuse the North Korea situation, AOC will continue to pick up supporters (which will be just the thing that gets Trump re-elected) and the market will continue to grind higher as most investors struggle to make money. It will be like the last 3 years since Trump got elected, all over again and many a hedge fund manager will have shitty performance as a result of this.

I wish I had better news for you but this is pretty much what we are looking at for 2019. It doesn’t get any easier but hey that’s why they get paid the big bucks right? Speaking of which, the only thing “markets” related that I’m actually looking forward to right now is watching the first episode of season 4 of Billions which aired on Showtime last night. I never watch tv and have very little bandwidth for media (except audio books which I enjoy on my morning walk) but Billions is the one show I do make time for. If you haven’t seen it yet just trust me and watch it. It’s an entertaining and fairly accurate portrayal of all the things that are wrong with Wall Street.