Diversification & Risk Adjusted Returns

All of the greatest investors of the world are students of history. Ray Dalio, for example, explains in his best selling book “Principles” that his strategy for understanding market cycles is to look back in history and identify the current situation as “another one of those”. This helps him figure out exactly how asset prices moved given a similar situation in history and how they may move in this current environment.

History tells us that growth which is funded by excessively rapid credit and money creation (QE) always eventually leads to a variety of asset bubbles and to financial, credit and currency crises. And with the Fed recently changing its official quantitative policy guidance to now clearly signaling dovishness, market consensus seems to be moving to a new baseline of no hikes in 2019 and a potentially a rate cut in 2020. If this is true, won’t the markets continue to do well for a long time?

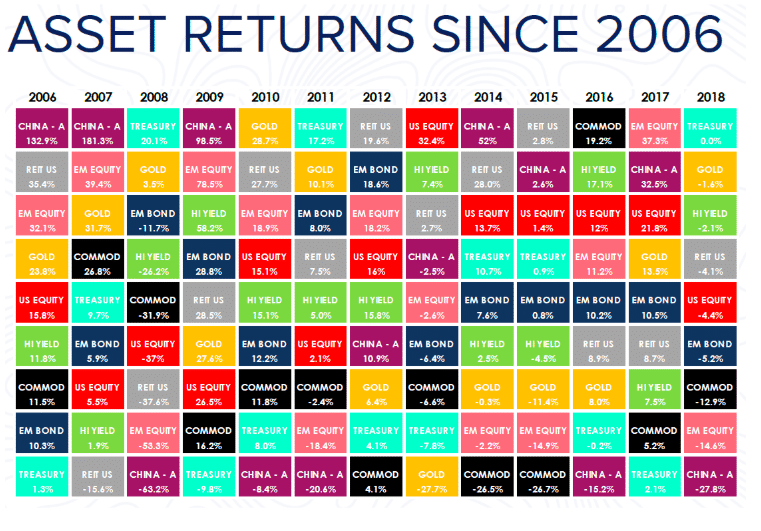

This chart shows asset returns over the last 12 years, since 2006. If you look at the top half of the chart, the assets that have outperformed the most have been equities, both US and Emerging Markets. They have dominated asset returns over the last decade. You’ll also notice that no single asset class has always outperformed over the long term, but rather that certain asset classes do relatively well some years, while others do poorly.

This is the basis of diversification when it comes to portfolio theory and the simple fact that greater diversification across asset classes enhances the risk-reward characteristics of a portfolio. The problem is, most people aren’t able to successfully outperform in a single asset class, let alone the entire investable universe of assets…

I still remember my very first job which was at Lehman Brothers in NY, a firm that no longer exists today. As an incoming analyst in their Sales & Trading program, I was required to go around the firm and “interview” for a seat on one of the many trading desks the firm had. I wasn’t smart enough to trade interest rates and wasn’t enough of a smooth talker to be in sales so I landed on the equities trading floor, which also happened to match my interest in stocks. But over the next few years, everything I looked at, day in and day out, was equities. That continued when I moved to Asia back in 2005 and was introduced to an entire new universe of stocks to read up and learn about.

People spend their entire careers trying to educate themselves and master investing in a single asset class. And to be expected, one of the first things I realized after managing an equities hedge fund for the last 5 years, was how limited my actual investable universe was. I stumbled upon this realization when looking at things from a risk perspective when trying to figure out how to hedge the portfolio of stocks I was dealing with. And with equity markets continually making new 10 year highs, it’s gotten me very very nervous as of late. The only problem is, I can’t exactly go outside of my firm’s mandate and use investor money to buy US REITs or Oil…that wouldn’t fly. The most I could do is take a more defensive posture within equities and adjust my exposure accordingly.

If only I could employ an active allocation approach…one that actively selects assets that will outperform based on where we are in the cycle…my risk and rewards would be much more balanced…

This coming weekend I will be presenting my full asset allocation framework at the Asia Wealth Virtual Summit 2019. I’ll be divulging exactly how I invest my own personal capital as well as our firm’s internal partner capital. And I’ll give you a hint — it’s not the same strategy I use at my hedge fund.

The Summit is a one-day online event that features nearly 15 high-profile investment experts across Asia, speaking about a variety of financial-based topics. Billionaire investor Jim Rogers is the keynote speaker, and other presenters include Whitney Tilson, Steve Sjuggerud, and Michael Covel.

Registration is limited, so secure your spot today! By following this link, you can sign up for the FREE live-stream of the event, held on February 23.

Hope to see you there.