Location, Location, Location

“In the real estate market, they say what matters is location, location, location. And if you’re a trader what matters is risk management, risk management, risk management.” – Peter Brandt

This past September marked 17 years since the September 11th attacks on US soil in 2001. It also coincided with the 10 year anniversary of the collapse of Lehman Brothers. The significance of those two events to me personally is that it was Lehman Brothers who brought me up to New York City in June of 2001 when they offered me a job in their incoming analyst class straight out of university. This was just three months before the 9/11 tragedy. I used to walk by the twin towers each morning on my commute to work at the World Financial Center and I still remember running up the West Side highway that day after the second plane hit like it was yesterday…memories burned into my mind for the rest of my life.

Time and the perception of time is one of those funny things that always gets distorted, especially for eager beaver, goal-oriented folks like myself. On the one hand, the daily grind seems to just crawl by, ever so slowly and annoyingly. On the other hand, when I look back, I always feel like time has somehow escaped me…that I am in danger of running out of it…that I need to do more each day…and that every minute has to count.

Maybe it’s because I have three kids now and watching them grow up is like viewing time in hyperdrive. Or maybe this is all just a setup for a great mid-life crisis that will hit me the minute I turn 40. Either way, it makes for an unusually contemplative mindset, particularly around the end of reporting periods such as month end, quarter end, and year-end.

I can’t believe it’s Q4 already. Things are starting to feel awful frothy in the world right now. And as I write these very words, I realize that I’m contradicting myself. Emerging markets have been the red-headed stepchild of the markets as of late, and continue to be so day after day. Whether it be a stronger dollar, a potential trade war with China or general country-specific crises (Turkey/Venezuela), the hits keep coming for EM investors with no reprieve in sight.

On the other side of the coin, you have a number of frothy asset classes, all looking due for a correction at some point in the foreseeable future. Stocks, bonds, real estate or private equity…you name it and somewhere there’s a bubble brewing just waiting to be deflated (okay I take that back, gold and precious metals look very cheap right now). There’s been a flurry of IPO activity these days as well, which to me always signals a rush for the proverbial exits. China is no less guilty than Silicon Valley in this regard. In fact, many would argue that China is the root cause of this current bubblicious environment.

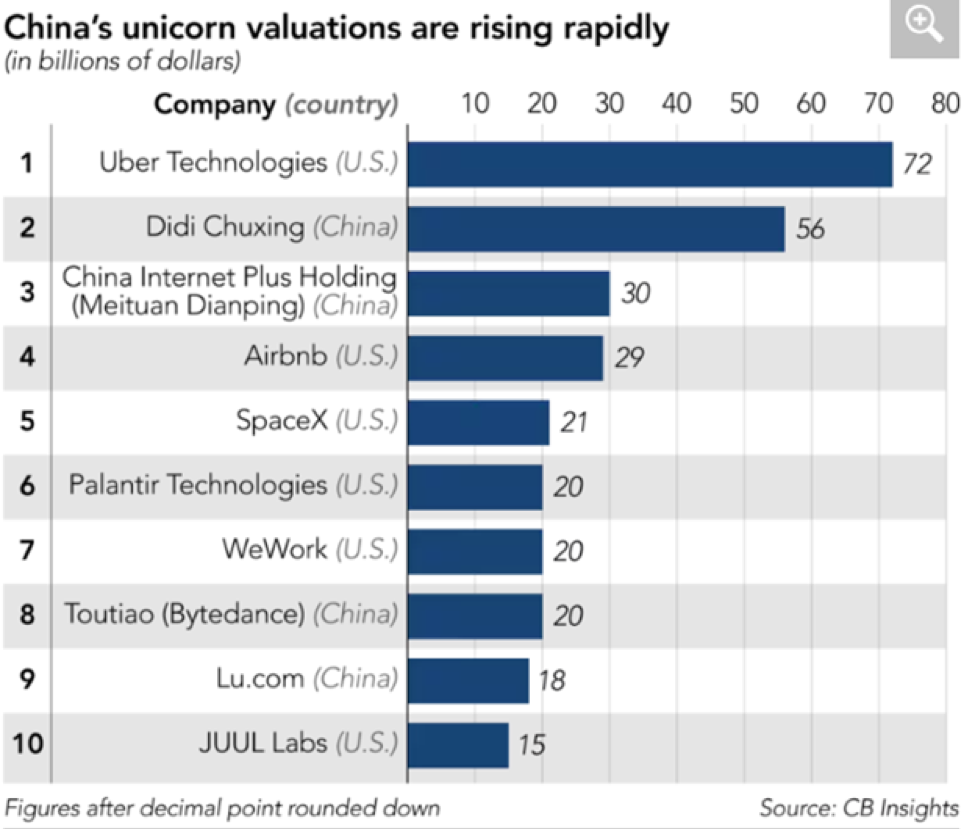

One of the Chinese unicorns leading this charge is Didi Chuxing, a company founded just 6 years ago which now boasts a valuation of over US$50b. Thanks to the massive influx of venture capital from both Chinese and global investors into the asset class of early-stage investing, Didi is just one of the nearly 100 or so Chinese private companies that are richly valued at over US$1b. This gold rush of capital has raised eyebrows of the Chinese government especially during a sensitive time for the country as it attempts to combat the over-leveraged banking system amidst a U.S.-China trade war.

And the second place prize goes to China…

Is the end nigh? Assets tend to remain overvalued for extended periods, particularly at the tail end of a bull market. Valuations are the first and easiest thing that most investors look at for guidance but the reality is that they make for horrible marketing timing tools when it comes to making investment decisions. The US markets have been loitering in “overvalued” territory since even before President Trump took office, but does that necessarily mean they will revert in the foreseeable future? Ironically, US equities for the last 18 months have not only been the best performing asset class. They’ve also been the safest.

Which brings us back to the fundamental skill of investing which is not the ability to “pick winners” but rather the ability the manage the one and only thing that you actually have control over — your downside risk. Ego tends to rear its ugly head in all human beings and the desire and need to be “right” often blinds us from what is much more important, and that is being correct (not losing money). As we enter the final quarter of 2018 have you checked our ego at the door and taken an honest look at your portfolio? What’s your risk management strategy going into year-end

P.S. Want to start building your network? My company Explorer Equity Group has decided to partner with StartCon (Australia’s largest startup and growth event) to host their Hong Kong pitch event for $1million dollars. The Hong Kong regional final will take place on October 16th, 2018 at Campfire’s Collaborative Space in Taikoo. In addition to seeing the best pitches, you will meet with some of the most reputable investors & entrepreneurs in Hong Kong. I’ve got free tickets for my readers if interested hit reply and let me know.