No Man’s Land

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

Investing is often times a lonely act. Especially if you are looking for a market-beating, non-consensus trades. You could be on a large trading floor sitting smack dab in the middle of all the hustle and bustle but still feel like the loneliest person in the room if your view goes against what the masses are thinking. But that is what is required to be successful when it comes to investing.

Jesse Livermore, as profiled in Reminiscences of a Stock Operator, is credited to have said “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Why is this the case? Why is this time not different? Livermore’s argument was that regardless of market conditions, price action is always determined by the participants themselves and human beings will always be irrational and emotional – which means that history will always repeat itself (or at least rhyme).

Once you understand this basic truth, that human beings will always act the same way over time, the challenge is to then figure out how to think independently of the herd and take advantage of resulting price movements during a risk event or market dislocation. Investors who are able to successfully take advantage of this are the ones who go on to become very wealthy. The rest fall in line with the herd and while there might be some relative outperformance, for the most part, their returns will mean revert and be average at best.

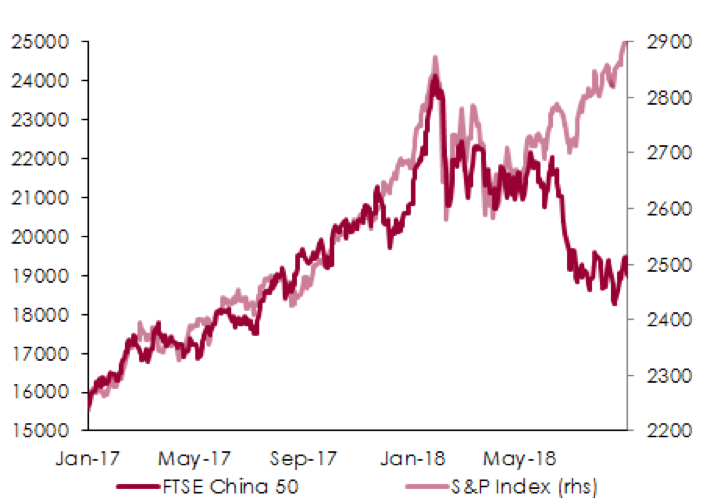

The one thing that has constantly been on my mind for the last few months is the growing divergence in Emerging Markets versus Developed Markets, mainly China vs. the S&P (since that’s the macro trade I have on at the moment). When looking at emerging markets and what is exactly behind the weakness we are seeing, there are only two things to consider: 1) the US dollar and 2) the sentiment around China’s economy.

Emerging markets have an inverse relationship with the US Dollar. When the dollar is strong, EM tends to be weak because EM performance is largely based on fund flow (which in turn is largely based on the interest rate cycle). Our current setup of robust growth and rising yields has caused an outflow of cheap fund flow out of EM back into the US markets. The fund flow can be large and oftentimes indiscriminate which ends up creating a vicious cycle for overall investors’ risk appetite and confidence in EM.

Last week’s ISM and payrolls data continue to show a robust US economy and it’s quite clear that the market is saying BUY the US and SELL China. With EM currencies hitting new lows (Indonesian Rupiah, South African Rand, Chilean Peso, etc) one might be tempted to pick the bottom on China right now (your print would be better than mine at least…) Keep in mind that for as attractive as valuations look at the moment, there are still plenty of bearish headwinds in our way before we see the light. Some of these headwinds include (but are not limited to) the trade wars, softer overall macro environment, and currency concerns.

Source: SilkRoad, Bloomberg

It is no secret that China’s economy will be the main driver of EM growth in the foreseeable future. The IMF estimates that China will surpass the US economy by 2026, if not sooner. But maintaining poise and conviction is critical in times like these is about as lonely and challenging as it gets. And one begins second guessing if they are dead right or have just gotten the call flat out wrong.

The greatest risk to my thesis as I see it right now is a continued bull run in the US dollar which will put China and EM into a very serious predicament. Does China hike and risk killing off economic growth or diverge from Fed policy and continue to ease which will ultimately lead to capital flight and a weaker yuan. The recent negative headlines around China’s internet space is certainly not helping my cause either…

Like a lone wolf trekking across the tundra, I’m sticking to my thesis for now. My entry and timing may have been slightly off but the overall view remains the same. The divergence in EM and DM needs to contract at some point but the real question is how long will it take? To be clear, I do believe that we are entering into a longer-term structural bear market but my gut tells me that we have one final leg up before the party’s over which will be the last real money making opportunity we have for a while.