The Pain Trade

“Why risk everything on one trade? Why not make your life a pursuit of happiness rather than pain?’” – Paul Tudor Jones

Every summer, for the last four years, my wife’s taken the kids down to Singapore for the summer holidays. Singapore is hands down one of the best cities in Asia for kids (much better than Hong Kong) home to one of the top-rated zoos in the world, an amazing aquarium, Universal Studios and just about every type of kid-friendly facility you could imagine. For that reason (and because packing when you have three little kids is an absolute nightmare for any type of trip) she decided to go stay there for a month this year.

I took advantage of being a weekday bachelor (have been flying back for the weekends to spend with the family) and stacked up a bunch of meetings, catch ups and events that I normally wouldn’t really care to attend if I didn’t have my evenings free.

The highlight of my month, however, was being able to host a panel last week during the annual RISE conference which occurs each year in Hong Kong. RISE has morphed into becoming one of the largest tech conferences in the world and as a member of the RISE Advisory Board, I had the unique opportunity to host a fringe event in conjunction with Startup Grind.

The panel took several months for me to pull together, but after begging and groveling I was actually able to pull together a panel of some of the largest names in early-stage investing. The panelists included Cody Shirk of Explorer Equity Group, Kyle Ellicott, founder of ReadWrite Labs Edith Yeung, partner and head of Greater China at 500 Startups and Chris McCann, community lead at Greylock Partners.

From L to R: Me, Cody Shirk, Kyle Ellicott, Edith Yeung, Chris McCann

It was a great time had by all and we talked about everything from trade wars to emerging tech, to crypto. The feedback from the attendees was overwhelmingly positive and we spent over an hour after the panel just answering questions from the audience.

The rest of the week was jam-packed with meetings, drinks, and more drinks. Needless to say, it’s been a busy July for me so far…almost busy enough for me to forget about markets for a few days…God forbid!

The Heng Seng index has been largely range-bound over the last few weeks trading tightly between the 28,000 and 29,000 range. With each Trump tweet and head fake of rising trade friction, we’ve seen some sharp pullbacks followed by some powerful rallies…all within this tight trading band. Momentum traders are starting to get fatigued with the whipsaw action and fundamental investors are trying to best position themselves for a breakout in either direction.

These pullbacks are scary for most investors and provide a glimpse into what life will look like when “the tide goes out.” It’s easy to feel smart in a bull market and these pullbacks provide a reality check for all. Alpha generators in a bull market quickly realize that they are merely beta followers in a bear market and a trend is your friend until it’s not, or so the saying goes.

In scanning broker news over the last several days I’ve seen the entire range of bullish to bearish sentiment. Brokers who were just three months earlier pounding the table proclaiming that we had significant upside in the markets are now saying there will be “material sell-offs” in the next 0-3 months based on slower economic growth and impacts from the trade war.

On the other extreme are pundits arguing that we are in the midst of a multi-year recovery in emerging markets which are due to benefit from a huge structural growth opportunity as US-China trade war concerns are largely priced in.

So which side is right?

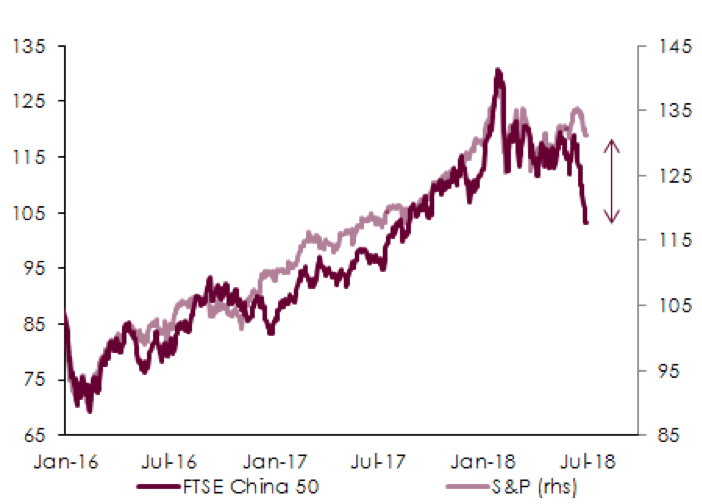

Admittedly, it’s hard to take a side right now, especially week after week as we grind away in a tight trading range with no convicted breakout in sight. After much pondering, I’ve finally come up with a macro trade that I am comfortable running right now to capitalize off of this large divergence in the S&P and FTSE China and hedge/protect my downside.

Source: Bloomberg, SilkRoad

The pain trade appears to continue to be the dollar and capital outflows from EM. With a structural shortfall of dollars, most of the fund flow appears to be driving back to US equities. This flow could be further fueled of course by the coming interest rate hikes or repatriation on the back of the tax deal but what remains clear is that it’s going to get worse before it gets better.

If past is prologue then these opportunities are exactly when we should be focusing on risk, rather than reward. Capital preservation and downside protection should remain at the top of your mind, and if you haven’t taken steps to insulate your portfolio then now would be the time to do so.