The Hero’s Journey

“Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.” – Bob Farrell

My wife loves watching horror movies. She has a strange morbid curiosity about her and absolutely loves the tension and pressure that these movies create while watching them. I, on the other hand, hate horror movies. I have the worst nightmares after watching them and can’t sleep at night afterwards. Call me a wuss but I have a hard enough time sleeping at night as it is…I don’t need some scary mental images to further keep me up at night.

Every horror movie (I’ve managed to sit through) usually follows the same dramatic structure. They almost always start off with a happy introduction of the protagonist or hero. The plot unfolds in a way that the audience member can related to the hero, which draws them in to believe that “this is something that could happen to me in real life”.

After the happy introduction there are usually a few “signs” that emerge that everything’s not okay. These signs tend to be subtle, but as an audience member, if you begin watching a movie knowing that it is a horror movie, you find yourself acutely aware of any action, sound or prop that might be out of the ordinary. You tend to be on the edge of your seat from the get go, just waiting for that dramatic twist to happen.

It becomes the classic case of the audience screaming at the protagonist “don’t do it!” or “don’t open that door!” as the director masterfully weaves the various elements into the film, heightening the tension with each and every scene.

But of course we all know that screaming at a screen does nothing for the safety of our protagonist. Inevitably, the hero does, what seems so obvious that they should not do, and the movie quickly becomes a horror movie as it progresses to the next section and the meat of the storyline.

As investors, it is our duty to limit our risk or protect our downside. Given the volatility and uncertainty we’ve experienced in the last few months, we need to start looking at things from outside of the fourth wall as opposed to getting too caught up like our hero in action.

As the plot thickens each and every subsequent week in our financial markets horror story, there have been a lot of “signs” that things are not what they appear to be. Some of these signs have been there for a while, and others have only popped up recently. Here are some of the more obvious signs:

- Overvaluation across the board in most asset classes which leads to resetting of valuations based on forward earnings

- Heightened volatility

- Improved consumer confidence, US labor market and wage growth acceleration which leads to inflation risk on the upside

- Tightening of global monetary policy

- Ever-increasing geopolitical risk

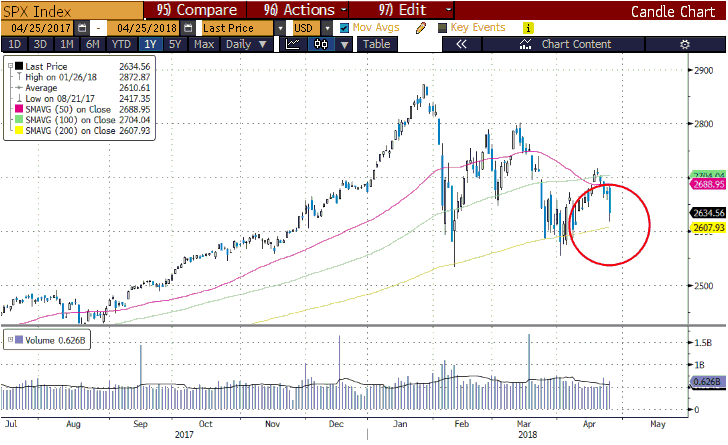

Last night the S&P took a beating, once again looking to test it’s 200 DMA. What started off as a strong earnings season has quickly unravelled into the beginning of a nightmare. Some of the major US bell weathers reported earnings with questionable margins and the recent tech rout in the smartphone supply chain added further uncertainty. The US 10-year yields once again tested 3% (the key level I spoke about before) and again the audience watching from the sidelines is screaming at the screen “don’t forget to hedge your longs!” and “take profit asap!”.

Source: Bloomberg

Let’s not forget that the real reason why people like my wife love to watch horror movies is so that they can experience the range of emotions that they would not dare experience in real life. Unfortunately, investing requires real money and real money affects real lives. The question we should all be asking ourselves is how much longer will this show go on before the real horror begins?

Hero’s redemption

One the most significant developments in the last month has been the introduction of trading in PetroYuan futures which are the yuan-denominated crude oil futures contracts. This news was largely underpublicized by mainstream media, particularly given the recent tug-of-war that Trump has been having with China and the trade war posturing that followed.

The significance of this event (and the reason it was hardly talked about) is huge as it marks yet another big step by America’s geopolitical rivals to move away from not only US’s sovereign hegemony but more importantly the US dollar’s role and dominance as the world’s reserve currency.

China is the world’s largest consumer of oil and as the US’s euphoria begins to wear off after it’s nine year gluttonous binge fest of free money printing, the country will sooner or later have to address its $1.2 trillion dollar annual deficit and the fallout which will ensue in the new reality of rising interest rates. The power is slipping away from the Americans and the 40% gains that the US markets have enjoyed since Trump’s election through February might be the last of this run as the harsh realities of debt, inflation and geopolitical instability take their due course.

The introduction PetroYuan futures trading, however, is yet another reason why I remain long term bullish on China. Make no mistake, I’m an American citizen and I love our country, but I am also a capitalist at heart and China is where I see the greatest opportunity for investment returns in the next decade. With Xi firmly in power (for the foreseeable future) of a country whose stock market is the second largest in the world (but which is severely underrepresented in global benchmarks) I see the market cap of the A-share universe only going in one direction. This is further backed by a strong long term structural growth trend in China’s urban middle class (estimated to be a whopping 75% of its population by 2022), the ridiculously high savings rate of Chinese households and the incredible “996” work ethic (9am to 9pm, 6 days a week) of the country’s younger working class.

Roll the credits

The final act of every horror movie usually ends with some sort of resolve or transformation. Either the hero gets redeemed despite the tragic flaw that was made earlier in the movie or, in other more sinister films, the hero actually dies leaving the audience in shock and dismay and oftentimes even more conflicted and disturbed than they started out.

Transformation is clearly the what we are after here as the happy ending of this tragedy play out. No one knows or can predict what the future holds but if there’s one thing we are certain of is that human psychology becomes irrational when it comes to financial markets in a time of turmoil. Don’t wait for the credits to roll on this one. Hedge your portfolio right now, or at least diversify to get the resolve that every investor so desires.