Cabin Crew, Please Be Seated

“The greatest danger in times of turbulence is not turbulence itself, but to act with yesterday’s logic” – Peter Drucker

When I was a young buck, fresh out of college and living it up in New York City, one of my favorite watering holes was called IdleWild. It was located downtown on Houston Street and it was an airplane themed bar (Idlewild was the original name of JFK airport before it was renamed to commemorate the President in the 1960’s)

The interior was exactly like an old school Boeing 747. Thirsty patrons would enter the bar through a jetway and were immediately greeted with airplane window panels, a concave ceiling and airplane seats installed at the tables around the bar.

My favorite part of the bar was actually the drinks menu, which looked exactly like an aircraft safety card that you’d find in an airplane seat pocket, only the cartoon images were of people partying, dancing and drinking.

Sadly, the bar has since shut down but as someone who absolutely hates flying I found it strange that I actually enjoyed hanging out on a plane, socially.

If you look at the odds, what are the actual chances of surviving a plane crash? More or less zero. So I understand why many people would actually prefer not to pay attention to the obligatory safety briefing before each flight and just block the scary thoughts out of their minds.

On the other hand you have the ultra paranoid fliers (you know the ones I’m talking about) that either have some sort of good luck ritual they perform as the plane takes off or are just fidgety in general. Some of these people end up “snapping” on the flight and going nuts.

I try to stay somewhere in the middle of these two flier types and generally a few cocktails before I fly helps calm my nerves.

Passengers on a plane are no different than market participants when it comes to the way they heed warning signs and emergency protocol. After years of hearing the safety instructions on a flight, I’d wager that most people would actually have no idea what to do in a real emergency situation.

It’s pretty much consensus now that there has been a paradigm shift in the markets, and the era of easy money is long gone. Volatility has come back with a vengeance and has manifested itself in the form of jittery investor sentiment.

Turbulence

This latest round of fun began late last week when our fun loving POTUS dropped the tariff bomb claiming that the US will impose a 25% tariff on steel imports and 10% tariff on aluminum. The immediate knee jerk reaction caused a selloff in equities as most buyers of steel just saw their manufacturing costs rise across the board.

This sparked a chain reaction leading the EU and Canada to both come back and threaten retaliation if Trump were to actually follow through with his claims. Global markets continued to sell off as Wall Street analysts scrambled to whiteboard out the implications of the tariffs. A number of other trade partners of the US subsequently came out voicing strong opposition, including German, Australia, Britain, and China.

After that initial commotion, investors are still jittery into the weekend. Trump continued his signature Tweet storm by adding this fuel to the fire:

Source: Twitter

Round 2

As with almost everything that our leader of the free world proposes, Congress was up in arms about this latest shenanigan. Even Speaker of the House Mr. Paul Ryan expressed his disagreement to the tariff plan. Trade policy has always been a particular point of contention within the Trump administration and it proved to once again cause dissention among the ranks.

This week actually started off fairly well (all things considered) as the bulls shrugged off the tariff news and gave it one more go. That was until yesterday morning when I woke up and read this headline:

![]()

Source: Bloomberg

Oh crap I thought and quickly checked the market only to find this:

Source: Bloomberg

Aaand we’re back. We’ve spoken before about how this would be the new normal…imagine turbulence being a regular part of every flight you took from here until…forever…yeah…cocktail anyone?!

Meeting of the Minds

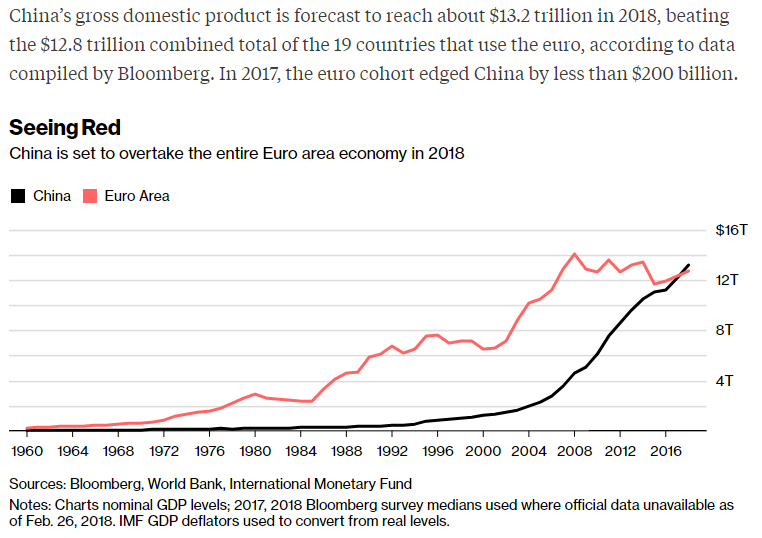

As investors were too busy scrolling through their Twitter feeds, everyone almost forgot about the National People’s Congress that was happening over on this side of the pond. While most of the highly censored newsflow was your typical state sponsored propaganda, the one headline that people actually did care about was Chinese Premier Li’s 2018 growth target announcement.

The number itself was the same as 2017’s coming in at “around 6.5%” with the noticeable difference in language being the omission of the phrase “striving for better results.” This once again left street side analysts and economists scrambling trying to decipher the meaning of the wording but in reality all that matters is the big number. After all, where the hell else can you go and get this kind of GDP growth in that developed of an economy in the entire world???

I’m not going to bore my readers with the minutiae of the budget and tax bullet points that were discussed at the NPC (most of it is just regurgitation anyways) but as we mentioned last week, what is abundantly clear is that President Xi has fully secured his grip and control over the country, which will likely include further crackdown on corruption and an overhaul of the leaders within government to align with his grand vision.

In short, Xi will not fail. And if you don’t believe, look at this report which was also quietly released to those who were paying attention.

Source: Bloomberg

So what do I do with muah money?

I had lunch today with a good friend of mine here in Hong Kong. I don’t get to see him very often but we always have lots to discuss. After covering the obligatory pleasantries of how our respective families are doing, we inevitably turned the discussion to investing.

We started off with all the usual suspect topics of discussion including Hong Kong property and how ridiculously overvalued it is right now, cryptocurrencies as an asset class and then of course the ultimate question which was “So what should I do with my money?”

After explaining to my friend that I’m not a financial planner, I basically broke down my investing framework to him, which more or less is the same that I would advise an institution or an individual.

During times of extended positive performance, excessive valuation and bulletproof market sentiment, I always focus on the risks and the downside. In times like these, that same paranoia that gives me the chills everytime I’m taking off in a plane drives me to focus on what could go wrong and contingency plan for the worst case scenario.

So how does that translate to our current market environment?

The cracks have well emerged in the system and heightened volatility is now the norm. The fasten seat belt sign is flashing and we need to be more careful now than ever before. We are already in a rate tightening cycle and potential positive US inflation surprises or another tweetstorm from POTUS are all it will take to set us off on another bout of turbulence.

What this translates to the investor is the need for diversification and holding cash. If you haven’t done so already, reduce your exposure to US equities and avoid your home country bias. Emerging markets remain highly underinvested as an asset class despite attractive valuations, increasing profit margins and accelerating GDP growth across the board. This won’t always be the case. Commodities, gold and real assets all tend to outperform in times of crisis, so get long some of that as well.

And as I told my friend at lunch today who was griping about missed opportunities in the markets…

No one ever went broke taking a profit (or holding cash)!