Thanks, But No Thanks

“What I would own is as much emerging-market equity as your career or business risk can tolerate” – Jeremy Grantham

Over my long and very undistinguished career on Wall Street, I’ve gotten recruited multiple times by competing firms to jump ship for a better opportunity. And by better opportunity I mean more money. The recruiting process at all investment banks is the same and while hiring managers like to beat around the bush about compensation, the hard reality is that all that really matters is what number they are willing to pay.

It’s the reason why 95% of people are in finance to begin with anyway.

A few times in my career when these opportunities popped up, I actually entertained them. I’d sneak out of the office claiming I had a doctor’s appointment, throw a tie on in the cab ride to the competing firm’s building and go through a few interviews to see how things panned out and ultimate what “number” they would offer me.

A few times the offers came in heavy, to the point where even my wife would say “take it, you idiot”. The money was usually well above what I was making and guaranteed for at least a year…but there’s one thing that kept me from ever actually accepting one of those offers and that was the fear of being “the new guy.”

As I would mull over the offer in hand, I would play out the scene in my head — walking into a brand new trading floor, not knowing a single soul, having to go around the desk introducing myself to everyone…and then settle in to begin the long and painful process of political posturing.

The fear of that first day alone was enough for me to never truly entertain a competing offer. Call me stupid but that alone stopped me from jumping around the street like many greedy finance peeps did, many of whom successfully made multiples that I did with each successive jump.

But one thing we know for sure is that “the new guy” always gets shit on.

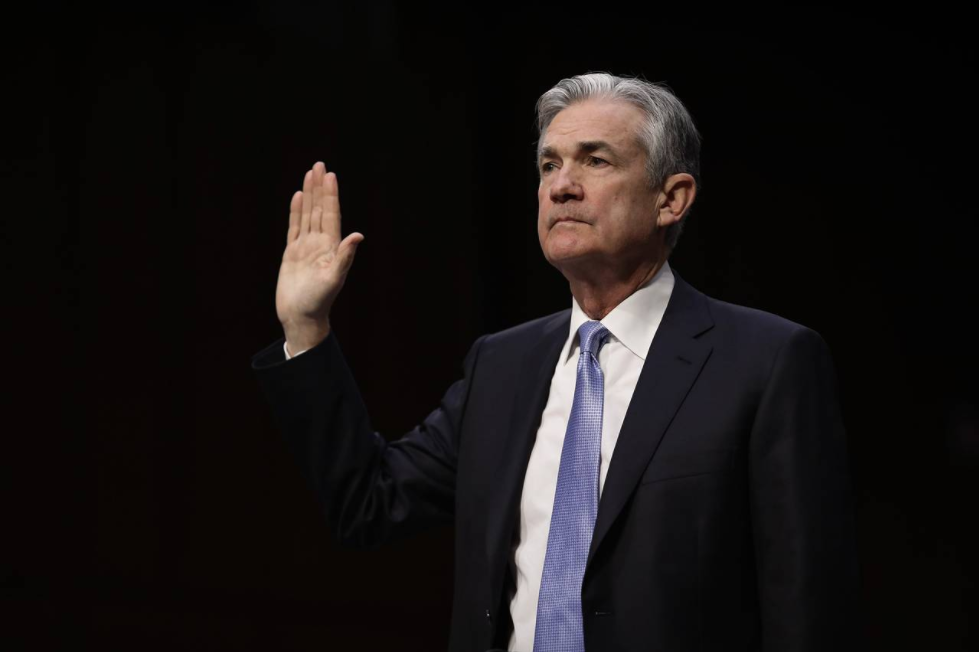

Our new guy Fed chief Jerome Powell certainly did not have the warmest welcome either his first few days on the job. In less than 3 weeks since he started as Chairman of the Federal Reserve, the markets have delivered a sharp decline in equities, a huge uptick in volatility and a continually weak dollar.

“I got this guys…” Source: WSJ

Call it beginner’s luck (in a bad way) if you like but a closer look tells us that our poor new guy just had bad timing. Powell joined the team at the end of a multi-decade bond bull market and inherited first and foremost a promise to reduce asset sales to half a trillion dollars within the next year. We’re also sitting at full employment, an expanding trade deficit, a weaker dollar, rising inflation and a promised trillion dollar infrastructure spend.

How’s that for a first day at the new job? Thanks, but no thanks.

As we’ve been saying ad nauseum for the better part of the last full year, the recent pullback, whether it was a hiccup or the smaller part of a larger downdraft in markets, the warning signs have been written on the wall for quite some time for those who have not been continually blinded by greed and market euphoria.

The era of free money has dangerously left investors with the mindset that markets only go in one direction (up) and if they don’t for whatever reason our trusty central banks will be there to bail us out.

After all that easing does anyone actually think that we can reverse the course without any collateral damage?

Prices tend to revert to the mean and when fundamentals are imbalanced (overvalued) historically it has always ended in tears. The underlying fundamental catalysts for the next big correction are already out there, it’s just a matter of which straw will break the camel’s back.

As we tread forward let’s be cognizant and equally cautious of two things:

- Accommodative monetary policy and the cheap cost of funding has stretched equity valuations to a point that we can no longer bake in a “margin of safety” into our analysis going forward. This joyride has also caused many investors to “over-invest” as prudence has given way to FOMO.

- What goes up almost always comes down and when it comes to equities at this stage in the late growth downcycle (and taking into consideration the buffett of shit that Powell has on his plate as the new guy such as inflation) equities WILL NOT take kindly to the new era of rising interest rates (confirmed by the hawkish Fed minutes which came out last night).

So what the hell do we do now?

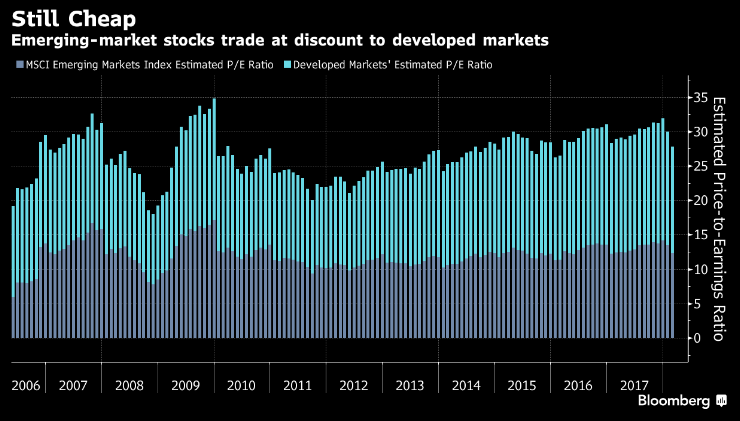

Source: Bloomberg

There is a silver lining in all of this though and I couldn’t be happier sitting out here in Asia smack dab within the golden opportunity that will soon present itself in emerging markets.

It is expected that the economies of emerging markets will grow by at least 5 percent per year for the next few years, more than double the pace of developed nations.

This is where you want to be.

And while initially, any major correction in the US will naturally bring down EM with it, this weakness will in turn become one of the greatest buying opportunities of all time in emerging markets.

Call it a mulligan if you like, but prudent investors will be right in trimming their US equity exposure and saving some cash for the next correction.

On the next major pullback when there is blood in the streets, buy more EM than US on the cheap…at least that’s what I’ll be doing.