Did You Just Hear That?

“I’m here for one reason and one reason alone: I’m here to guess what the music might do a week, a month, a year from now. That’s it. Nothing more. And standing here tonight, I’m afraid that I don’t hear – a – thing. Just… silence.” – John Tuld, Margin Call

If you’ve been listening close enough you’ll have heard that something is happening over in China right now. The announcement came quietly over the weekend and was largely hidden from (or vastly downplayed) in mainstream media.

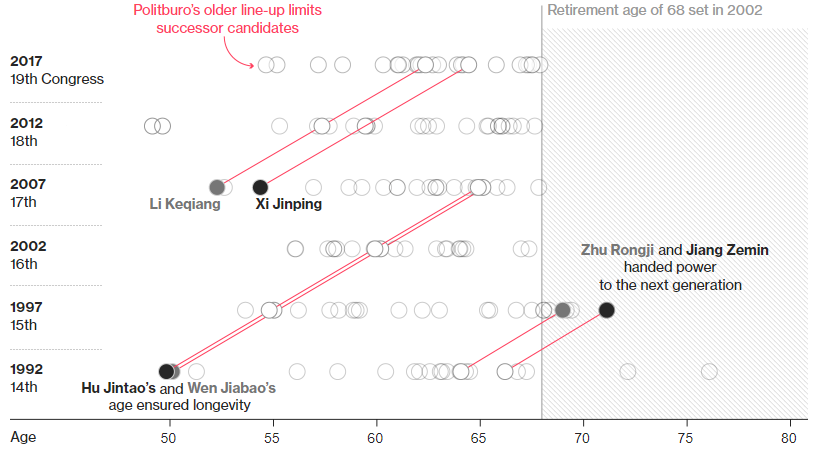

Last Sunday China announced a proposal to scrap the two-term limit for presidency of their country. Under the guise of “political continuity for economic reforms” China all but solidified President Xi’s likely status as a “Prez-4-Life” (or for the foreseeable future) which was actually hinted at last October during the Communist Party Congress when he chose not to nominate a clear successor.

Nonetheless, this was still taken as somewhat of a shock by the Chinese especially since it happened just two Presidents after Deng Xiaoping established the idea of “collective leadership” back in the 80’s during the Cultural Revolution. The collective leadership and two term limits were meant not only to ensure that power would not be concentrated to a single person but also to provide stability to the Chinese people during times of political transition (something all of us Americans hold in high regard especially after seeing what happened last year with Trump.)

Source: Bloomberg

Chinese Netizens didn’t appreciate the news and took to social media to express their dismay, with some bloggers even comparing the move to their nefarious neighbors in North Korea.

Sadly however, it being China, everything ended up being censored.

By Monday morning most of the media scrubbing was done, as the government fully blocked articles and deleted posts that even hinted at negativity towards the decision. A flurry of articles were then run praising the Communist Party’s grand vision and President Xi’s leadership.

#onlyinchina

Let’s take a moment to dissect the long term implications of this announcement. On the one hand it does make sense. There was no possible way that the economic reform of China driving it from an export driven economy to a domestic consumption economy was going to happen in just 10 years (two terms).

Clearly this would have to be a longer “experiment.”

And who better to continue driving it than the man who’s currently doing a fantastic job. Now that “growth” isn’t the number one objective the country, perhaps the focus can turn to more mature country issues that China will inevitably face such as social stability, poverty and the environment.

On the other hand, we must consider the long term risks of one man retaining the three pillars of power (Communist party chairman, President, and head of the Central Military Commission) indefinitely. How much longer will he serve? Is this a step backwards into a full-blown dictatorship? What happens during the next leadership transition now that there is no prescribed way of passing the torch? Could there be greater risk of the country imploding?

We’ve all witnessed Xi’s heavy hand in cracking down on corruption, most recently with the private companies that are seen to be threatening the country’s domestic economic stability. Let’s not forget that economic pain always directly translates to social instability which is something that Xi simply will not tolerate at this point in his reign. And when people get wealthier, the one thing they always want more of a say in is politics.

The one thing we know for sure is that with great power comes great responsibility. If Xi f$%ks this up, then it’s on him and him alone…

Degenerate Gamblers

The market, on the other hand, seemed to shrug off what will likely be the most important political announcement of the year and instead took to their vices to quell their fears.

Source: Bloomberg

This is one of the nuances that I love about Asia. Nothing beats a little gambling therapy during times of uncertainty…

Let’s be clear on one thing — this is a major political event and probably the most important one of the entire year. It was also highly structured and choreographed, not just China shooting from the hip so to speak. The widely accepted fact is that Xi will be allowed to serve beyond the 2 term limit and remain the paramount leader indefinitely.

So what does that mean for us?

I hate to break it to you but China will not fail. They are well on their way (already there by some metrics) to becoming the number one economy in the world. The sooner you understand and appreciate this trend the better off you will be, especially from an investment standpoint.

Next week kicks off the National People’s Congress (NPC). In addition to Xi’s power play being confirmed, some other themes to look out for include GDP growth targets, fiscal consolidation, monetary policy stance and property taxes.

Meanwhile, stateside, volatility picked back up. Overnight we had another scare after Powell’s testimony to Congress affirmed a strong economy and all but confirmed the appropriate path for monetary policy normalization to include four rate hikes this year, not just three. US 10 year yields moved up to 2.91% and equities puked.

As we approach our monthly swing cycle of payrolls data (March 9) followed by inflation numbers four days later, I fully expect markets to trade choppy between data points from here on out and as investors we must maintain focus.

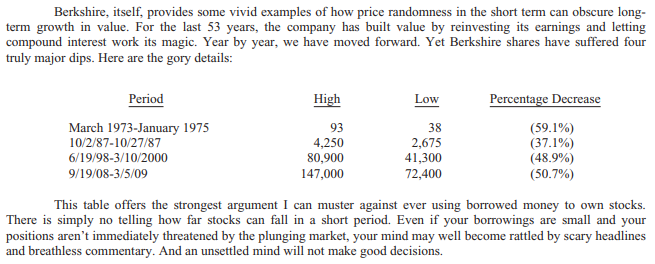

What better source of investing wisdom than the annual letter from the Oracle of Omaha himself, Warren Buffett which also hit the tape over the weekend. This annual classic, which should be required reading for all investors of the world, came in a little shorter than usual this year at just 17 pages but chock full of knowledge nonetheless.

Source: http://www.berkshirehathaway.com

Whether or not you believe that last night’s market action was “just another blip” or confirmation of the beginning of a bear market, I think we can all agree that the following quote is highly relevant and noteworthy for us from here on out:

“…it is insane to risk what you have and need in order to obtain what you don’t need.”

Over the last 8 ½ years, global equity markets have rewarded investors with over 15% annualized returns. Suppressed interest rates have allowed investors to pay a higher price for future earnings, inflating P/E ratios all along the way. That era is over. It’s time for those hedges folks, whether that is going to cash or adding some S&P shorts. Higher risks and lower returns is here to stay and when the next whipsaw comes (and it will come, guaranteed) you’ll only have greed to blame.