Death By A Thousand Loans

“Truth is like poetry. And most people f*cking hate poetry.” – The Big Short

When I was a young boy, I would regularly get into trouble horsing around with my older brother.

My parents, as was the case with most first generation Asian immigrant parents to the US, were extremely strict and disciplinary, particularly when we didn’t obey their house rules.

Nevertheless, boys will be boys and my brother and I would routinely bent the rules and would end up breaking something, upsetting my stay-at-home mother, who would then tell my father what transpired when he got home from work in the evening.

And with that always followed discipline in the usual form of spanking.

After what seemed like an eternity of lecturing us and then grilling us to tell him exactly why what we did was wrong (lessons learned), my Dad would ask my brother and I who wanted to “go first” with the spanking.

After the first few times of delaying the punishment, I always raised my hand first so as to “get it over” with.

The agony of seeing my older brother writhing in pain on the floor after getting his spanking was nearly as unbearable as the actual punishment itself.

From then on, I always take punishment first.

This past week we saw a long overdue but welcome correction in the markets. I say welcome because quite frankly, I’ve been nervous about the markets for quite some time now.

HSI Index Price Action This Week, Source: Bloomberg

I absolutely hate it when I see markets trending up in the way they have without any major pulls backs and I get extremely nervous that we could be merely one data point or news flash away from a sharp correction.

And just like the impending punishment of a rigorous spanking, I would much rather get a market correction over and done with than delay what could potentially be a huge crash.

Market participants are fickle and sentiment can shift as quickly as the tide turns in the sea.

As usual, I find myself thinking about risks again and what could potentially blow this whole party up.

It’s no secret that one of the greatest “risks” in the Asian market, that has been slowly rearing its ugly head, is the debt situation in China.

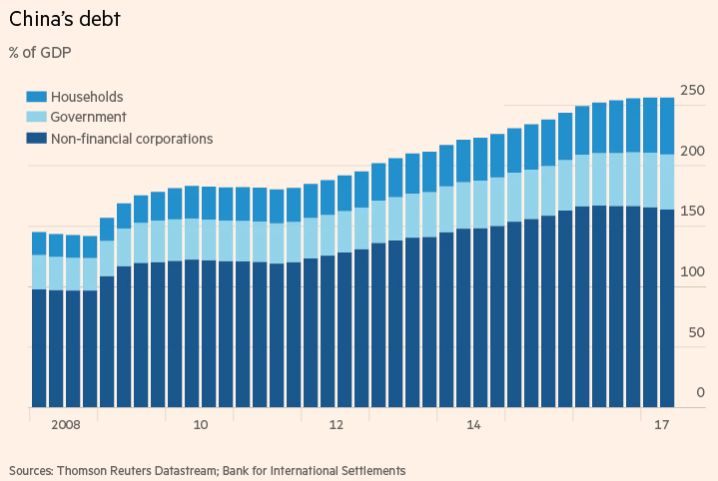

As the second largest economy in the world continues it’s prolific rise on the global stage, so do the underlying financial risks grow, particularly the debt levels in the corporate and household sectors.

Source: www.ft.com

Shadow banking, property bubbles and financial leverage are all buzz words that refer to what simply is the largest the pink elephant in China’s room — debt.

How did we get here?

It all started during the Global Financial Crisis (GFC) back in 2008. China, in what was seen at the time as a preemptive counter measure to cushion the economy from a “hard landing,” began it’s lending binge which grew the banking system into the monster it is today.

China’s banking system is now the largest in the world, even larger than the entire Eurozone. The rapid rise in China’s debt to GDP level has been a cause for alarm to the the IMF and the Bank for International Settlements (the central bank of central banks).

Amidst this debt binge emerged a new asset class of “shadow banking” which was basically a clever way for the banks and financial institutions to get around regulations by offering riskier products such as asset management and trust products with higher returns.

This created a vicious circle of lending.

The debt, which was originally supposed to be invested into the real economy, was instead simply being invested into higher yielding, riskier investment instruments, doing nothing to boost the health of the actual economy.

It would be the equivalent of using your tuition money to bet on cryptocurrencies…or something like that…doh!

Here come the Sentinels

Of course, it wasn’t long before people started taking notice. First came the vulture hedge funds who noticed the cracks emerging in the system, the overleveraging of the banking system and the so called “ghost cities” that appeared to have popped up all around the country.

Hedge fund legends such as Jim Chanos, Kyle Bass, Hugh Hendry and Crispin Odey all started speaking out against China’s “issues” and started building short positions to express their doom and gloom views on the country.

In August of 2015, we saw China’s yuan devalue by 1.8% causing many of these vultures to double down on their bets against China claiming the “big default” was now right around the corner.

Sadly, one by one, these short sellers have capitulated and thrown in the towel.

Nearly a decade after the beginning of the debt binge, China appears to still be humming along just fine.

The truth will set you free

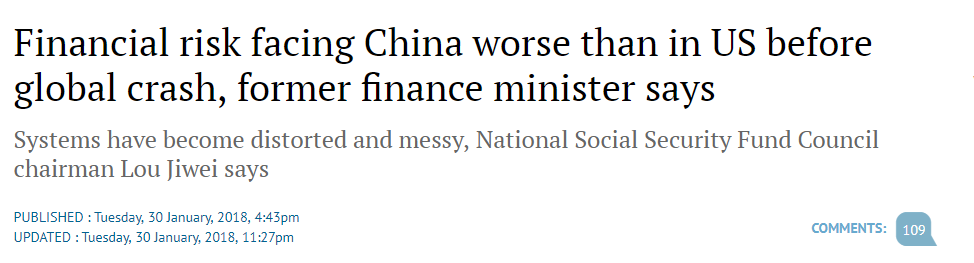

Lou Jiwei was China’s finance minister from 2013-2016 and has been vocal about his concerns regarding the debt situation in China.

And while this might appear to be a “whistleblower” from the very inner workings of the Chinese government, the reality is that he is still a pawn in the entire machine.

Source: SCMP

China decided that the world should hear it straight from the horse’s mouth and the current administration has been very public in acknowledging their issues and even more so about how they plan to address them.

President Xi Jinping, at the Communist party congress in October 2017, outlined a complete plan regarding new regulations, policy documents and directives to curb speculation, reduce leverage and increase corporate governance in the system.

This has affected banks, insurance companies and even corporates that have engaged in such lending activities in the past.

What outsiders don’t realize about China is that the country is what is called a “managed economy.” The country owes all of their debts to itself, and it has trillions of dollars in reserves to cover those debts if need be.

The bottom line is that they are going to do whatever it takes to insure that their country does not fail.

And this is where most investors get it wrong, because of the disconnect between fundamentals and reality in China.

I’ve personally experienced this on a micro level before trying to short a Chinese company with horrible fundamentals, and a huge amount of debt.

After days of research, analysis and diligence I determined that I had found the next “Enron” of China and boldly built my short position on a small, highly leveraged airline leasing company.

Carson Block here I come…?

Not exactly. Contrary to what appeared to be a screaming short…the stock, after missing earnings, did the unimaginable…

It rallied.

It turns out there was simultaneous news out that this particular company was a potential acquisition (read “bailout”) target of a large State Owned Enterprise in China.

The stock went thru the roof.

And I barely was able to cover my short in time at a loss…with my tail between my legs, of course.

In the very same way, China all but came out last week at Davos gaurenteeing a bail out should another crisis occur. Yes…really!

Fang Xinghai, the deputy chief of the China Regulatory Securities Commission (CRSC) came out with the following:

“We have too much debt in our system. If something bad happens, we have learned from the US Financial crisis, and we will move swiftly to contain the risk so that panic caused by a small institution does not spread.”

But he didn’t just stop there…

“Those who are ‘shorting’ China and betting of a financial collapse, thinking they can make money, will be wrong again,” he concluded.

So there you have it folks. Talk about moral hazard. You can buy whatever you like, irrespective of fundamentals, and you don’t worry about it…the Chinese government has got your back!

It seems investors took this to heart as is evidenced by the price action of the Big 4 Chinese banks as of recent.

Holy guacamole.

As the global bond market sell off continues and the Fed just today decided to delay a rate rise until March, I can only wonder at what point yields will warrant a stock market reversal.

Even Alan Greenspan, the world famous central banker who coined the term “irrational exuberance” came out on record the other day saying we are in the middle of a bubble.

As we continue our slog through earnings season just ahead of another potential government shutdown in February, the positive earnings surprises are coming in hot and heavy at 56%.

I can’t but help to want to raise my hand now to take my spanking in the market first, rather than stand on the sidelines and watch my fellow investors writhing from the pain of their inevitable losses.