We Like Making Money The Hard Way…

“Keep an eye on what the TVs at lunchtime eateries are showing. When most have talking heads yammering about Amazon, Tencent, and Bitcoin and not Patriot replays – just as late 1999 featured the latest in Pets.com – we are probably down to the last few months. Good luck. We’ll all need some.” – Jeremy Grantham

One of the most intriguing nuances of living in Asia and Hong Kong specifically is the annual “false start” to the year that we get, with Chinese New Year (CNY) almost always falling within a 6 week window of the calendar New Year.

The entire city goes on hold for about 4 days and many shops and restaurants even are closed during this time. There also is the customary (and still after 12 and a half years for me…very awkward) giving of lai see or red packets to staff, service workers, younger siblings and basically anyone that has helped you in some way in the past year.

But the best part of it all really is the annual mulligan that we get on our New Year’s Resolutions. Apparently (according to U.S. News) 80% of resolutions fail by the second week of February anyway but you don’t have worry about that here…if you’ve fallen off the wagon already, you can always try again after CNY.

If only the markets were as forgiving…

As we enter 2018 which is the ninth consecutive year of the US market bull run, it is clear that global market valuations are lofty. The big question that most investors are asking themselves right now is how far along the “bubble” curve actually are we?

The same FOMO trade logic that I spoke about before can be applied to global markets and as experienced investors we know that everything is fine…until it’s not.

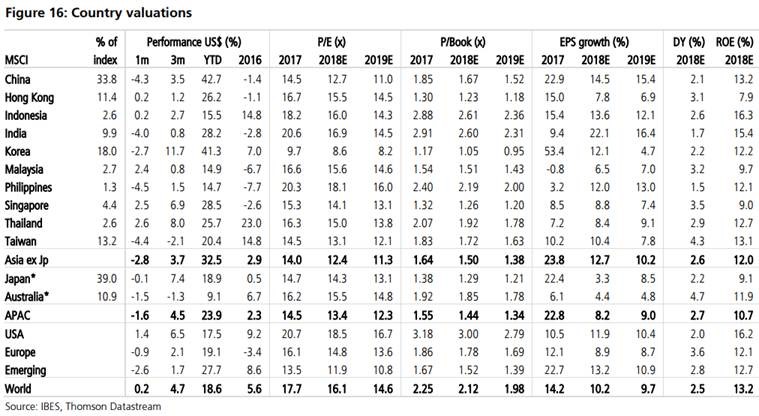

A quick glance at global valuations tells us that the US by and large leads the charge trading at a hefty 20x PE, 13x EV/EBITDA and 1.9x div yield mostly off the back of the prolonged tech-led re-rating and tax cut incentives. The EU is not far behind at 16x PE, 9.4x EV/EBITDA and 3.4% div yield attributed to the domestic recovery theme — both regions are at near 10-year highs across multiple indice.

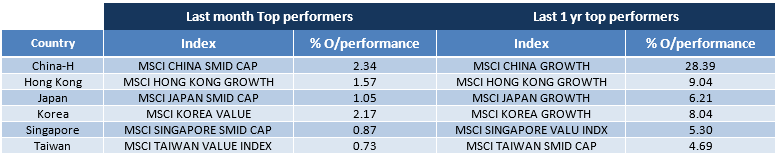

Hong Kong remains at the lowest valuation when compared to any country in the other two regions, trading at a “modest” 13.3x PE, 9.4x EV/EBITDA and 3.4% div yield. A quick look at pan Asian MSCI indices paints the same picture for the region:

Source: Deutsche Bank

As fundamental or value tilted investors have found, it is increasingly difficult to buy anything elsewhere due to increasing asset prices. As such, many have rotated into Asia or to cash to look for diversification and outperformance.

But this is not new news for any of our readers here. With seemingly persistent robust economic growth in the US fueled by gains in employment, tax reform, and tax repatriation, we are once again stuck trying to figure out where exactly on the bubble curve we sit right now.

FOMO or not all astute investors know that the greatest gains are usual made at the peak of a bull market run, which is how momentum trading (and trailing stops) earned their seat at the table to begin with. Sadly, no amount of backtesting or valuation analysis will help us with timing the top.

So instead of expending energy on market timing, let’s once again turn our attention to the risk management side of this business. A core tenant of investing is capital preservation and with this in mind let’s look at what could — potentially — might — just go wrong in 2018.

- The single greatest risk in my mind for the year will be central-bank policy. We spoke about this last week and in previous notes in the past. The era of “all you can drink free flow happy hour” money is about to come to an end and the cracks will begin in the bond market first. Corporate debt is now at record highs and as the cost of capital slowly begins to creep up, the crappy companies with high leverage and low interest coverage ratios will one by one drop like flies.

- This pandemic will eventually seep over into equities causing a sharp correction when the music stops. Historically, the average bull market lasts roughly 9 years (here we are!) and the average bear market lasts just 18 months. During bull markets stocks appreciate 500% and during bear markets they decline an average of 40%…so it’s advisable to have your seatbelts loosely fastened in the meantime.

- Barring the doomsday scenario, if the skies remain blue for a while further, the opposite threat of inflation comes into the picture. The US has had low inflation for as long as this bull market run has existed and if that beast decides to rear its ugly head then once again central bankers would have to speed up the pace of tightening which leads us directly back to scenario 1 above without passing GO.

- China debt, capital controls, growth slow down and trade wars with Trump are all present but somewhat overlooked risks to the global financial system. Less than 3 years ago we saw China aggressively devalue the RMB causing shockwaves around the world. The pandora’s box of China remains a risk regardless of how much control and manipulation investors think the government has.

- North Korea still remains the long tail risk that is talked about but not really thought about. The probability of escalation is admittedly low, but it remains a risk nonetheless.

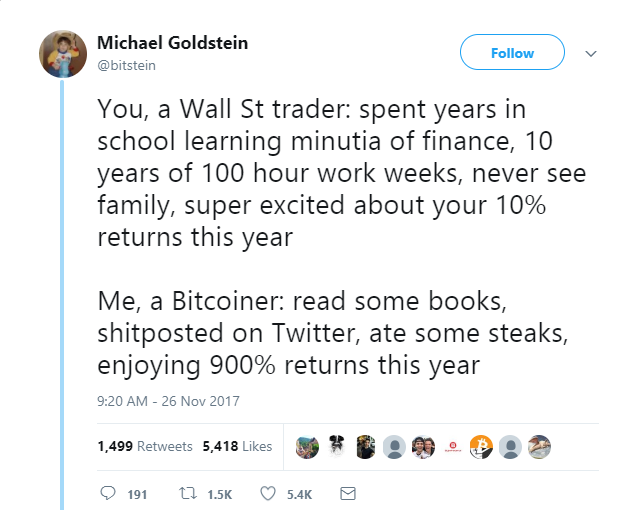

- Last but certainly not least is a risk I like to call “crypto poisoning” and no I’m not talking about the inherent risks of ICOs (which we all agree that 95% will go to zero) or the various currencies like Bitcoin being banned for fear of terrorism. What I am talking about when I say crypto poisoning is the psychological effect that outsized returns in cryptocurrencies (from seemingly unsophisticated investors) has on the actual institutional investor community. I know this all too well myself. After slaving over markets last year and printing a very respectable double digit return in my portfolio, I find myself looking at my non-investor friends who have printed triple if not quadruple digit returns in their crypto portfolios. I often catch myself saying “What’s the fking point of trading stocks!?” Especially when I read tweets such as this:

Source: Twitter

Ahhh the joys of this wonderful world of crypto. As my business partner always say “It’s okay Jay…we like making money the hard way…”

And finally (and only since we’re on the topic) here is probably the best (read most balanced) argument I’ve read for Bitcoin as a store of value, from the perspective of an institutional investor (@jlppfeffer). It’s a bit on the technical side (at least for me) but the TL;DR version is that Bitcoin is the strongest contender to be a store of value in the future and utility coins (such as ETH) have limited upside. This is in no way a recommendation (you’ve read my arguments and framework on crypto already) but I’ll leave you with this final quote from the white paper which does fall inline with my strategy as well:

“For those stuck at the step of whether or not to invest, the logical thing to do is to move past that point and focus on position sizing. If you’re more sceptical, invest less. If more confident, invest more. But even for the most sceptical, you might constructively ask yourself, why wouldn’t you invest USD 1? Well, rationally, you probably would. Now how about USD 2? Repeat until you get to your Bayesian optimal position size. Given the significant risk of loss, in most circumstances the correct answer is probably a long-term, buy-and-hold, unlevered investment of a low single-digit percentage of assets (at cost).”

Happy New Year!