Groundhog Year

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. – Mark Twain

Wall Street has always been known as the heart of capitalism.

It is also notorious for the ego that develops when you get some of the smartest people in the world trying to out compete each other.

More often than now, it’s in fact less about the money and more about being right (winning).

Looking back one year in history to the beginning of last year here are the assumptions that most investors at the time had:

- Interest rates were due to rise soon which would in turn cause strength in the US dollar

- China’s RMB would most certainly depreciate to 7 or 8 to the dollar

- The “Trump Bump” was a one-off event and unsustainable due to the already lofty valuations

- Tensions between North Korea would be the black swan event that could eventually blow up the stock market

Now all of the above assumptions were very reasonable and many of them are still applicable today, one year out. But the reality of the situation is that none of them ended up transpiring.

Defying all odds the S&P steadily gained every single month last year printing a 20% return in a single year versus the historical average annual return of 8% since 1945.

This brings us to quite an interesting crossroads today. As we mentioned last week, there appears to be a wave of consensus global growth forecasts that have been revised higher for a variety of reasons in both developed and emerging markets.

Over the last couple days a lot of the Fed talking heads have also come out endorsing gradual rate hikes this year. Cleveland Fed President Mester even went as far as to say “I think the risks are still balanced but I do think there are some salient upside risks.”

As typical Fed speak usually goes, they’ve collectively taken the wait-and-see, data dependent approach before taking any action that may potentially derail this current joyride.

I usually spend a good part of January catching up on the annual street side outlooks that the various brokerage houses publish. Most of the time it is the same themes being recycled and regurgitated over and over again.

I spent a good 30 minutes this week skimming over the Goldman Sachs Investment Management’s nearly 100 page 2018 Outlook. When I finally got to the end, I realized that I should have just come straight to the “In Closing” section. In summary they basically state:

“Just because we are entering the ninth year of the bull market for equities does not mean it is necessarily over.”

Cheers Goldman! Thanks for enlightening us with your profound discovery.

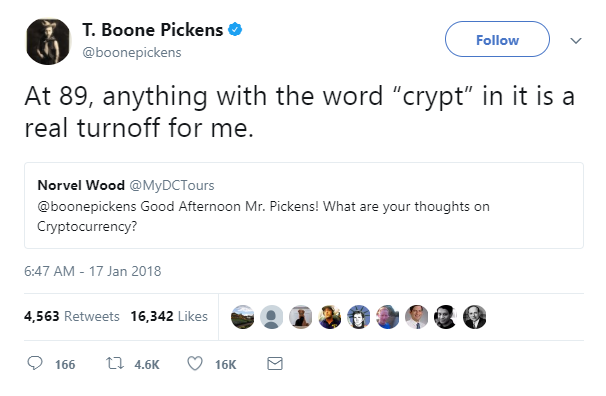

BitConnect Disconnect

Source: Twitter

This week we saw a huge disturbance in the force cryptoland. During the 48 hours between midnight on Monday to midnight Wednesday crypto speculators saw perhaps the largest broadbase correction ever seen in that space.

Ironically this correction occured within days after this New York Times article started making the rounds and this Bitcoin Rapper’s song went viral. Perhaps some of the old tell tale bubbles signs from history are in fact true…

The main culprits of the sell off were regulatory in nature, stemming from China and South Korea both taking hard stances at cracking down on crypto exchanges and trading.

But the icing on the cake was the news that BitConnect, a recent ICO company, was a fraud. BitConnect’s business model was to invite crypto speculators to deposit Bitcoin into their company which would then be lent to others a a very high interest rate (upwards of 40%) per month.

It was basically a loan shark pawn shop operating a classic Ponzi scheme that was successful only due to the general euphoria in cryptoland. And while BitConnect was one of the first such schemes to blow up, I can say with 100% certainty that it won’t be the last.

The volatility in crypto was incredible those few days. Social media was littered with talking heads from both bull and bear camps aggressively taking both sides of the debate. Tears were cried, money was lost and blood was shed. The Koreans seemed to take it harder than anyone else out there and the fact that cryptocurrencies both rise and fall in price seemed to be an unfathomable concept to them

When the dust finally settled this morning, crypto addicts were greeted with this headline:

Source: Bloomberg

The interesting thing to note was that during the 48 hour or so sell off, all the chat rooms I am in were by and large silent about what was happening.

Either these chat room guys were too busy buying the f-ing dip (BTFD) or they were too shell shocked to say a thing after seeing their portfolios down 30-50% and trying to wrap their heads around the fact that this entire bubble might all go to zero. I’m guessing it was the later.

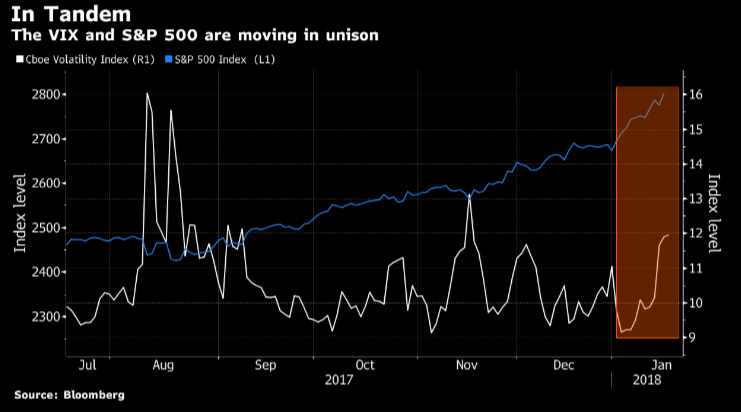

The most interesting chart of the week

As I was scanning my usual morning newsflow today I stumbled across this chart:

Source: Bloomberg

We’ve spoken before about the low level of the Cboe Volatility Index (VIX), a measure of options prices, as being the big head scratcher in the market all of last year.

This past week, during the same time that cryptoland was blood bathing (and possibly related to it), the VIX steadily climbed 17% even as the S&P printed new highs.

These tandem moves of the VIX and the S&P rarely happen (the last time was nearly 2 years ago) and it made me even more paranoid than I already am about current valuations and global market risk.

Now I admit, my risk assumptions for 2018 are largely the same as 2017, and if you just listened to that side of my argument last year you probably would be pretty pissed off at me right now for having missed the entire meat of the 2017 rally.

Investors continue to be desensitized and euphoric to current stretched valuations and because of this I still firmly believe that prudent investors should pivot towards international equities which are still cheap on a relative basis.

Don’t put all your eggs in one basket. Throw in a few hedges in the mix. Diversify. Yada Yada Yada.

At the risk of beating a dead horse, the biggest question I have going into 2018 is the pace of the tightening cycle where the current consensus expects gradual rate hikes to continue since inflation remains low.

While it will be hard to stop the current market momentum which has been underpinned by upbeat investor sentiment on synchronized global growth data, the danger I see with valuations being at such lofty levels is that small negative changes at the margin could potentially trigger a much larger sell-off.

No one holds a crystal ball as to what the future holds, so let’s remind ourselves of John Templeton’s aphorism:

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria”.