Investors In The US View This As A “Warning”…

“Ahhh, this porridge is just right” – Goldilocks

It’s been a full week after Thanksgiving and the barrage has finally ended. You see, the best part about Thanksgiving (other than pumpkin pie) is the unique annual four day window in which you can literally purge all the mailing lists that you don’t want to be a part of anymore.

Between all of the“Black Friday Special” emails and the “Cyber Monday Final Offers”, my inbox was flooded with a constant stream of deals, offers and last chance specials from lists I didn’t even know I was part of.

It’s a golden opportunity to de-clutter and unsubscribe from all of them (jaykimshow.com not included!)

Thanksgiving marks the beginning of what is usually a seasonally strong period of economic data and somewhat volatile market action, as investors try to posture around how to position into year end.

For those managers who have made their returns for the year, an easy option is to take some profit, color up and sit out the rest of year and wait for bonuses.

On the other hand are the frustrated investors who missed the entire year long rally waiting for the drawdown that never happened.

Many of these investors have fund “mandates” requiring them to deploy a certain amount of capital before the end of the year and find it increasingly infuriating that the so called “dumb money” make a killing when the “smart money” did not.

The net effect and irony of the situation is that between the two of these investor types and of course general holiday cheer, the markets are very likely to steamroll ahead and print new highs into Christmas.

It is in the height of this market euphoria that investors often let their guard down.

I just spent the last week up in Tokyo talking to investors, traders and portfolio managers about general views of the markets and overall sentiment.

Aside from Bitcoin mania which has fully overtaken the country (literally every person I met had to comment on) it seems that all is well in the Land of the Rising Sun.

Bolstered by Abe’s landslide victory in a snap election, the Nikkei Index achieved its longest winning streak of 15 consecutive days last month, the most since 1961.

Nikkei’s YTD gains Source: Bloomberg

Half of Japan’s gains for the entire year came from this rally as foreign investors’ interests were renewed despite being net sellers last year.

The recurring theme is that most foreigners were “under invested” in Japan and that another 20-30% gain could be seen from here through early 2018.

All good?

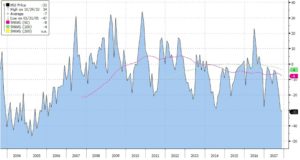

The big head scratcher of the year has most definitely been the suppressed market volatility we’ve seen.

Many investors in the US view this as a “warning” signalling equity market excess.

The reality is that when equity volatility has reached this low level historically, it was not the equities that imploded first, it was the bonds.

Savvy bond investors are well aware of the impending danger and fixed income traders have been selling Treasuries all year ahead of what might be the beginning of the end.

U.S. JP Morgan Treasury Investor Sentiment All Client Net Long – 12 Year Low

Source: Bloomberg

The problem is that most of the global fund managers still have their guard down and expect this goldilocks scenario of strong growth and low inflation to last well into 2018.

A recent Bank of America Merrill Lynch Global Fund Manager Survey taken last month showed that managers are still willing to take above average risk even though markets seem expensive because they are convinced inflation will remain low which will keep the Fed from hiking aggressively OR if in the event that there is economic weakness…well…the central banks will just bail them out again.

At some point the combination of Fed tightening and rising inflation will cause a major bond correction which obviously will have contagion effects to the equity markets.

Nevertheless in the spirit of Thanksgiving and the holidays, I suppose we should all give thanks to the Fed and US Equity markets which appear to be the gift that keep on giving.

Smart beta continues to allocate a maximum weighting towards equities and momentum traders are having a field day (vs. value guys who are sitting on their hands) as the melt up continues.

Everyone knows that the largest gains are made at the very peak of the bull market.

Emerging market equities always fare well when the dollar is weaker. On the brink of a tightening cycle we could see some initial weakness in EM equities but only after investors have ridden this rally to the moon.

Want To Invest In Asia? If so you’ll need a guide. I help outsiders become insiders in Asia’s most profitable deals. Learn more here.