Are We There Yet?

“Only when the tide goes out do you discover who’s been swimming naked.” – Warren Buffett

Earlier this week, I arrived to work and as I sat down to log into my Bloomberg terminal my boss (and founder of the hedge fund I work at) walked in shaking his head furiously.

“F*&%ing hell, these markets…” he muttered as he walked into his gigantic glass office.

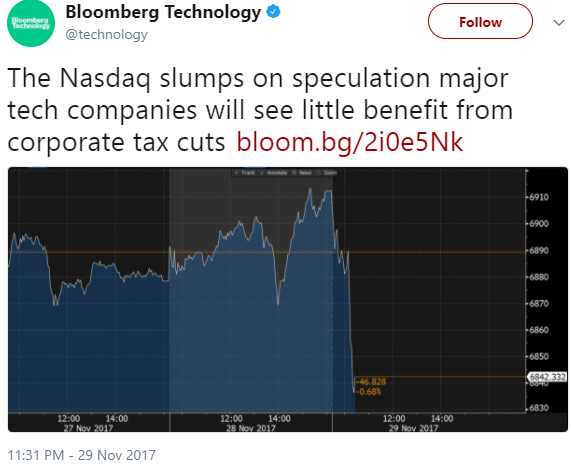

As my screens slowly loaded, I saw monitor after monitor come online, each displaying a sea of red. He was clearly talking about the overnight tech sell off that happened in the US markets.

To be honest, I’m not sure why he or anyone was that surprised to begin with. We’ve been discussing how overvalued the markets have been for months now, and a 1% correction in the Nasdaq was hardly a cause for panic.

Nonetheless, much pain was felt by investors after that selloff and naturally the first thing that any investor tries to do after the fact is come up with a seemingly intelligent way to explain it.

Finance dbags are notorious for this pattern of behavior — always trying to commentate the day after a risk event, convoluting and distorting simple price action with large vocabulary and technical terms to sound smart.

“Profit Taking”, “Sector Rotation”, “Smart Beta”, and “Quant” are some of the commonly used explanations when describing large market moves, particularly on the downside.

I particularly like “Quant” as an explanation (excuse). It’s like this magical machine driven force in the markets that render individual investors (particularly fundamental ones) helpless.

Another fan favorite of mine is “Price-insensitive Sellers”…which doesn’t really make any rational sense at all to me. How can any investor let alone seller in the market not care about price be price?

To add further confusion in the price action this past week was US President Donald Trump scoring his first big legislative victory — US senators finally passed a sweeping tax overhaul. (Corporate tax rate to be lowered from 35 percent to 20 percent.)

“Investors are selling tech after the huge runup this year and rotating into US Tax cut beneficiaries…”

Really?

Under the new tax plan tech giants like Apple and Google would be allowed to repatriate up to US$1.3 trillion in capital parked outside the US at a preferential tax rate of 10 percent.

Isn’t that good for tech companies?

Oh yes…but maybe too good. And if taxes are low and companies fare too well then the extra stimulus to the US economy and job market would make a case for the Fed to hike interest rates more aggressively…

“SELL, Mortimer, SELL!”

This sort of investor game theory becomes more and more prevalent the further along we move up the bull market curve. Market Psychology and market reverse psychology — it’s all fun and games until someone loses money. But astute observers of the market would have noticed the speed and intensity of the correction which is very telling of how skittish investors really are.

Who will be caught naked when the tide goes out?

Fed Fun

The Fed meets next Wednesday on Dec 13th with the market pricing in a 98.3% probability of a 25bps hike. Additionally, market consensus now fully expects at least four Fed rate hikes in 2018. This would put the Fed funds rate at over 3 percent by 2019. But given where we are and the skittishness of markets at this current time, who knows how aggressively Powell will tighten when he takes over in Q1 2018.

The Fed can-kicking for the larger part of the last decade has often been attributed to their obligation to protect the “greater good” — as in, the US being the largest economy and bellwether of global markets has been burdened with the responsibility not to selfishly tighten and produce a negative knock-on effect around the world. It also allowed them to make a ridiculous amount of money by simply longing the stock market.

Such martyrdom!

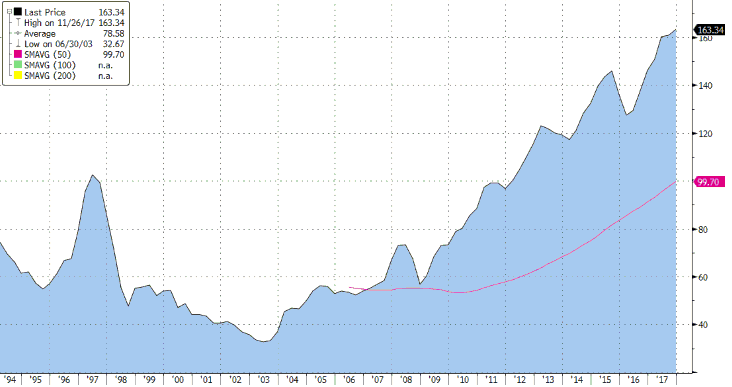

In the meantime, Hong Kong has experienced housing price inflation nearly comparable to the current crypto bubble we are experiencing.

Dammit…I tried so hard not to talk about crypto this week…I really did…

Speaking of which, here’s an interesting tweet from Peter Brandt that was making the rounds this week regarding the crytpo move. I’ll let you decide what to do here cause quite frankly, I don’t have a fking clue…

Source: Twitter

Hong Kong has ample liquidity in its banking system and remains one of the most well capitalized countries in the world. As such, there has been a lag in the rate hike cycle despite being pegged to the US Dollar. The Fed raised rates four times in the last 2 years and the Fed funds rate has risen to in aggregate a full 100 basis points. By contrast, HIBOR, (Hong Kong’s interbank offer rate) has only risen 70 bps.

This interest rate differential coupled with continued lack of supply has caused the astronomical rise in the Centa-City Leading Index, Hong Kong’s best guess gauge of secondary housing prices.

Centaline Property Centa-City Leading Index Source: Bloomberg

One can only imagine what will be left on the beach during “low tide” if the Fed starts to hike aggressively into a falling equity market, amidst a selloff in China’s debt market caused by the crackdown on shadow banking and corporate borrowing.

I usually loathe December markets. I hate them even more right now. It’s been a challenging year and I continue to believe that December will be a rough (volatile) month for investors.

It’s only a matter of time before we see the crowded longs starting to unwind which would cause a snowball effect as “Quant” and “Smart Beta” join the selloff.

At least that’s how I’m going to explain it…