FANGs and FAANGs and FAAMGs, oh my!

The recurring theme of the year among just about every contrarian and value investor has been the argument that markets, by any measure, are overvalued.

I’ve written about it ad nauseum myself over the last several months.

In fact, the only topic I’ve beaten to a pulp more than frothy market valuations is…Bitcoin. Go figure.

The Buffett Indicator for the US, which the almighty Oracle of Omaha deemed as “probably the best single measure of where valuations stand at any given moment”, currently clocks in at 139%.

This Market Cap-to-GDP ratio is essentially the measure of the total value of all US publicly listed stocks divided by the country’s GDP.

There is no debate that tech valuations are lofty and the market capitalization of any combination of the above FANG group of stocks is well into the trillions of US$…which is about the size of the entire economy of India!

FANG stocks have done so well that the NYSE even came up with their own NYSE FANG Index which inevitably has led to the FANG Index futures contract, which launched earlier in the month.

Astute investors are aware that history rhymes…

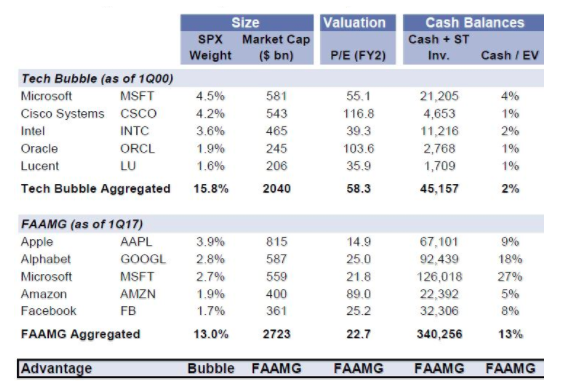

And current tech valuations have been likened to the dotcom bubble 17 years ago which caused one of the largest crashes in market history.

Granted 17 years is a long time, why is it different this time around?

Source: Goldman Sachs

It’s no doubt that all of the FANG names have solid progressive business models, and best-in-class leadership.

But are all of them as profitable as investors think?

Are investors simply extrapolating out the most optimistic multiples to justify their spending spree?

When I read the articles like “Is Amazon getting too big?” and “Big Tech Has Become Way Too Powerful” I can’t help but think that the very fear that comes from the threat of technology (AI, machine learning, big data) is the main driving force causing investors to pile their dollars right back into the companies that are supporting this trend — the trend which will inevitably lead to Judgement Day.

We’ve all felt the chill of the technology Big Brother looking over our shoulders (here’s a recent scary link I found).

I found Andrew Ross Sorkin’s recent interview on CNBC in Saudi Arabia to be particularly haunting as a glimpse into what all this FANGs investing will lead us to.

“Which is better Andrew, Betterment or Wealthfront?” Source: CNBC

“Which is better Andrew, Betterment or Wealthfront?” Source: CNBC

By the way, the robot Sophia was awarded a Saudi citizenship afterwards, much to the chagrin of Saudi women who then took after social media to voice their anger that a robot actually had more rights than they do.

Black gold…

Speaking of which, Saudi Arabia is going through some interesting times.

I actually grew up in Saudi Arabia (some of my readers may not know this).

My father worked as an engineer for the oil company Saudi Aramco and I spent my childhood from the age of 5 to 15 in the sand observing the local culture.

So I found the recent events particularly intriguing, including the arrests of Prince Alwaleed bin Talal (34th richest man in the world worth US$28b) and the continued muscle flexing of Prince Mohammed bin Salman to clean up the apparently rampant corruption of the country.

There are a lot of moving parts to the Game of Thrones being played in the Middle East at the moment.

But suffice it to say that those who were arrested in the witch hunt were clearly not on the same team as Crown Prince Salman.

These sorts of anti-corruption drives happen when there is a much larger shift taking place in the background which many do not recognize.

The larger shifts almost always involve international banking interests, very much like what we’re seeing in China.

Any sort of power plays that happen in the Middle East happen for one reason: oil. It is a known fact that the Salman & Co. have made aggressive deals with Russia and China on energy and defense.

As the world continues to de-dollarize we will continue to see such power plays unfolding in strategic countries around the world.

Since the Petrodollar is on its way out and with oil making up over 90% of Saudi’s revenue, the mad scramble to list Saudi Aramco (my dad’s old company) is more urgent now than ever before.

The Saudi Aramco IPO will likely be the largest initial public offering in history and in a surprising twist of fate this week, the world’s largest equity investor, Norway’s sovereign wealth fund, made a public statement saying they wanted “out” of energy.

That’s quite inconveniencing for the bankers who are running the $100 billion deal to have lost their best potential cornerstone investor. The plot thickens…

Tencent for the win…

As Donald trump concluded his Asia tour this past week, which he deemed a “tremendous success” (would he deem it any other way?) for a split second (2 trading days) earlier in the week the markets were looking a little less bulletproof.

With the VIX finally steadily climbing above 13, nervous investors wondered if the music had finally stopped.

Asia once again saved the day after big earnings wins from some of China’s tech giants including Alibaba, JD.com and of course the market darling Tencent (700.HK) reporting “blowout” numbers after the close on Wednesday giving the markets a reason to shake off the fear and keep the party going. (does 27x FY18 EV/EBITDA actually sound reasonable to you??)

Even Yixin Group (2858.HK) a Tencent-backed online car-loan provider which IPO’d this week surged as much as 32% on its debut fully riding off the coattails of the Tencent Midas touch and the global FANGs phenomenon.

Stocks, as we well know, tend to take the stairs up and the elevator down, especially when earnings multiples have been extrapolated out at the peak of a bull market.

Investing psychology is akin to consumer psychology from an advertiser’s point of view.

How do you get someone to upgrade their car? You must first make them unhappy with the one they currently drive.

What catalyst do you think will make FANGs investors unhappy with their current holdings?

Want To Invest In Asia? If so you’ll need a guide. I help outsiders become insiders in Asia’s most profitable deals. Learn more here.