Vincent Vega and Marsellus Wallace’s Wife

One of the most influential movies from the 90’s (whether you liked it or not) was Quentin Tarantino’s film Pulp Fiction.

The film pushed many boundaries of violence and adult themes but Tarantino’s use of three separate stories told out-of-sequence only to intersect together in the end, was nothing short of masterful.

In the third narrative sequence titled “Vincent Vega and Marsellus Wallace’s Wife”, the protagonist Vincent Vega (played by John Travolta) is tasked with taking crime boss Marsellus Wallace’s wife Mia (played by Uma Thurman) out for a night on the town.

The two have a great night dining and dancing and end up back at Mia’s place.

In minutes leading up to the main scene of the sequence, the camera switches back and forth between Vincent talking into the mirror in the bathroom trying to convince himself not to sleep with Mia, and Mia outside in the living room discovering mysterious drugs in Vincent’s coat pocket and snorting them.

It is one of those classic scenes where you want to stand up in the theater and shout “Don’t Do It!!” at both of them, at the top of your lungs.

Vincent walks out of the bathroom and before he lets on about his final decision, he finds Mia collapsed on the floor foaming at the mouth.

The sequence ends with Vincent stabbing Mia in the heart with an adrenaline shot after she overdoses on the mystery drugs, but in the end she is alive. Ironically Vincent’s loyalty to crime boss Marsellus remains uncompromised.

I find myself having that conversation to myself in the mirror a LOT these days, very much like Vincent Vega did, especially when I am forced to wrangle with the FOMO of Bitcoin as it continues to make new highs each and every day.

It was an eventful week in crypto land with the big story being the CME group (owner of the world’s largest exchange) saying that it plans to introduce bitcoin futures by the end of the year.

It’s clear that the CME group themselves have capitulated as only a month ago they publicly dismissed such a plan.

But that didn’t stop the speculators from propelling the coin’s price past $7000.

Lloyd Blankfein (CEO of Goldman Sachs) seems to be having the same conversation as Vincent in the bathroom as well on the cryptocurrency and admitted once again that he isn’t sure what to make of the whole thing.

“I read a lot of history, and I know that once upon a time, a coin was worth $5 if it had $5 worth of gold in it. Now we have paper that is just backed by fiat…Maybe in the new world, something gets backed by consensus.”

On the other side of the argument this week was Tidjane Thaim (CEO of Credit Suisse) who proclaimed that the speculation around bitcoin is the “very definition of a bubble” and that in the history of finance, such speculation has “rarely led to a happy end.”

Dream Within A Dream…

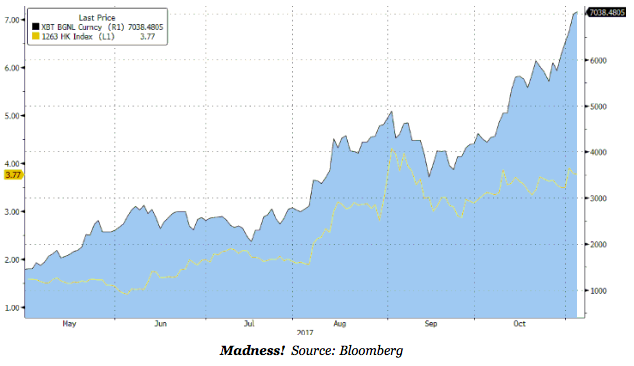

If you’re wondering what Asians think of this cryptomania, take a look at this chart below that exemplifies the manic (and incredibly senseless) gambling mentality of Chinese investors.

PC Partner Group (1263.hk) is a small $200m Hong Kong based company whose core business is the design, development and manufacturing of video graphics cards.

Somewhere along the way the company became associated with cryptocurrencies, specifically the mining of Bitcoin and retail punters are now using the company as a proxy for Bitcoin!

The stock price has more than doubled in just the last 6 months.

By the way, Coinbase (the popular VC backed cryptocurrency broker) just added 100k more users in the 24 hours after the CME’s announcement.

Picks and shovels anyone?

Back to reality…

Ok, enough of that. Can we please talk about “real” markets now?

Investors have had one hell of a night drinking and doing the twist in this seemingly endless rally.

And despite a short selloff (and quick spike in the VIX) after the changing of the guards in China last week, Amazon, Google and Microsoft released their earnings igniting one of the largest Nasdaq rallies of the past decade.

Last week delivered us a slew of great economic data including durable goods, new home sales, PMI and the highest Consumer Confidence number since 2000!

But the headline of the week was President Trump’s nomination of Jay Powell as Yellen’s successor next February as Fed Chair.

Powell is a lawyer by training who’s been a Fed governor since 2012 and has never dissented from an FOMC vote.

This means his nomination will be widely seen as dovish and most importantly as someone who will bring continuity to the gradual and measured approach of Fed tightening in the future.

And of course, that is exactly what the market wanted.

Stocks continue to trend higher and vol continues to trend lower…and once again we find ourselves in the bathroom talking to ourselves in the mirror…“Don’t Do It!!”

Over in Asia as the curtains closed on the 19th Communist Party Congress “changing of the guards” the usual party line takeaways of “SOE reforms”, “property cooling measures” and “financial deleveraging” were making the rounds.

But what interested most investors was President Xi highlighting the fact that growth will not be the #1 priority anymore but rather a focus on raising the broad based quality of living in China.

That’s basically his nice way of saying “we can’t sustain 7% GDP growth anymore, so get used to mid 6’s y’all…”

A final bullet point that is up for interpretation was regarding the RMB and Xi’s comments on the further internationalization and loosening of capital controls going forward.

Skittish investors will remember the August 2015 devaluation well (and the pain that ensued globally thereafter) and flag this as a possible risk for further depreciation/devaluation.

Fool me twice, shame on…who?

Video Graphics Cards (GPUs) are widely used for mining bitcoin. They can take a heavier load than CPUs.